Notice Regarding Issuance of Stock Options (Stock Acquisition Rights)

Note: This English document has been translated from the Japanese original for reference purposes only. In the event of any discrepancy between this translation and the Japanese original, the Japanese original shall prevail.

Tosei Corporation assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translation.

To whom it may concern

October 28, 2015

Tosei Corporation

Toranomon Tosei Building, 4-2-3 Toranomon, Minato-ku, Tokyo

President and CEO: Seiichiro Yamaguchi

Securities code: 8923 (Tokyo Stock Exchange, First Section)

S2D (Singapore Exchange, Mainboard)

Contact: Noboru Hirano, Director and CFO

TEL: +81-3-3435-2864

Notice Regarding Issuance of Stock Options (Stock Acquisition Rights)

Tosei Corporation (the "Company") hereby announces that it resolved, at the meeting of the Board of Directors held on October 28, 2015, to issue stock acquisition rights as stock options to Directors, Executive Officers and employees of the Company (including persons who are seconded to the Company’s subsidiaries; hereinafter the same), and directors of the Company’s subsidiaries in accordance with Article 236, 238 and 240 of the Companies Act.

The amount and other details of the remuneration provided as stock options to Directors were approved at the 65th Ordinary General Meeting of Shareholders of the Company held on February 25, 2015.

- 1.Reason for issuing stock acquisition rights as stock options

Stock acquisition rights shall be issued as stock options for the purpose of further incentivizing people to work for improving the performance and enhancing the corporate value of the Tosei Group.

- 2.Outline of issuance of stock acquisition rights

- (1)Name of stock acquisition rights

Tosei Corporation Fifth Series of Stock Acquisition Rights - (2)Total number of stock acquisition rights to be issued

5,090 units

The total number above is the expected number of stock acquisition rights to be allotted. In the event that the total number of stock acquisition rights to be allotted decreases due to fewer people applying for subscription than expected, etc., the number shall equal the total number of stock acquisition rights to be allotted. - (3)Persons to whom stock acquisition rights are allotted and number of such persons, and number of stock acquisition rights to be allotted

Directors of the Company Five persons (of whom two are Outside Directors),

340 units (of which 40 are allotted to Outsider Directors)Executive Officers of the Company Seven persons, 490 units Employees of the Company 196 persons, 4,010 units Directors of the Company’s subsidiaries Four persons, 250 units - (4)Terms, including class and number, of shares delivered upon exercise of stock acquisition rights

The class of shares delivered upon exercise of stock acquisition rights shall be ordinary shares of the Company and the number of shares delivered upon exercise of each of the stock acquisition rights (the Number of "Shares Granted") shall be 100 shares.

In the event that the Company conducts a share split (including allotment of ordinary shares of the Company without contribution; hereinafter the same for a share split) or a consolidation of shares, of ordinary shares of the Company after the date on which the allotment of stock acquisition rights is conducted as stipulated in (15) below (the "Allotment Date"), the Number of Shares Granted shall be adjusted according to the following formula. However, the relevant adjustment shall only be made to the number of shares to be delivered upon exercise of stock acquisition rights that have not yet been exercised as of the relevant point in time. Any fraction less than one (1) share resulting from this adjustment shall be rounded down.

Number of Shares Granted after adjustment

= Number of Shares Granted before adjustment

× Ratio of share split or consolidation

In the event that the Company conducts a share split, the Number of Shares Granted after adjustment shall apply on and after the following day of the base date of the share split (or on and after the effective date if no base date is set). In the event of a consolidation of shares, the Number of Shares Granted after adjustment shall apply on and after its effective date. However, in the event that a share split is conducted under the condition that a proposal to decrease surplus and increase capital stock or legal capital surplus is approved at a general meeting of shareholders of the Company ("General Meeting of Shareholders"), and a date before the date of conclusion of the General Meeting of Shareholders is set as the base date of the share split, the Number of Shares Granted after adjustment shall apply on and after the following day of the date of conclusion of the General Meeting of Shareholders.

In addition, in the event that, after the Allotment Date, the Company conducts a merger, a company split or a share exchange, and in any event equivalent to these in which it becomes necessary to adjust the Number of Shares Granted, the Company may make the adjustment that the Board of Directors deems necessary.

- (5)Value of property to be contributed upon exercise of stock acquisition rights

The value of property to be contributed upon exercise of each of the stock acquisition rights shall be an amount equal to the value to be paid for one share to be delivered upon exercise of stock acquisition rights ("Exercise Value") multiplied by the Number of Shares Granted.

The Exercise Value is either the amount obtained by multiplying the average value of the closing price for regular transactions of the ordinary shares of the Company at the Tokyo Stock Exchange on each day (excluding any day on which no trade is made) during the month prior to the month containing the Allotment Date by 1.05 (any resulting fraction less than one (1) yen shall be rounded up) or the closing price on the Allotment Date (or the closing price of the nearest preceding day if no trade is made on the day), whichever is higher.

- (6)Adjustment of the Exercise Value

-

(1)In the event that, after the Allotment Date, the Company conducts the following (i) or (ii) regarding its ordinary shares, the Exercise Value shall be adjusted according to the respective formula below (the "Exercise Value Adjustment Formula"). Any fraction less than one (1) yen resulting from this adjustment shall be rounded up.

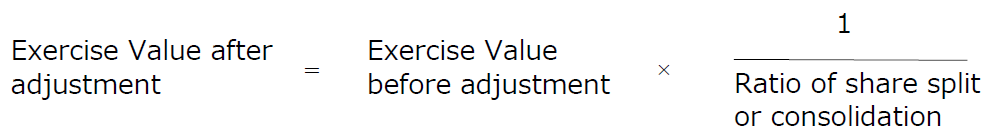

(i) When the Company conducts a share split or a consolidation of shares:

(ii) When the Company issues new shares or disposes of its treasury shares for a value less than the market value (excluding the following cases: sale of treasury shares due to a demand for sale of shares less than one unit by a holder of shares less than one unit" stipulated in Article 194 of the Companies Act, transfer of treasury shares in accordance with Article 5, paragraph 2 of the Supplementary Provisions of the Act for Partial Amendment, etc. of the Commercial Code, etc. (Act No. 79 of 2001), exercise of subscription rights to shares under Article 280-19 of the Commercial Code before the enforcement of the Act Partially Amending the Commercial Code, etc. (Act No. 128 of 2001), conversion of securities that are or may be converted to the ordinary shares of the Company, and exercise of stock acquisition rights that may claim to deliver the ordinary shares of the Company including stock acquisition rights incidental to bonds with stock acquisition rights):

i. The Market Value" used in the Exercise Value Adjustment Formula shall be the average value of the closing price (including a quotation; hereinafter the same) for regular transactions of the ordinary shares of the Company at the Tokyo Stock Exchange (excluding any day on which no closing price is made) for 30 transaction days starting on the 45th transaction day preceding the date on which the Exercise Value after adjustment shall apply" stipulated in (2) below (the "Application Date"). The average value" shall be calculated to two decimal places and rounded off to one decimal place.

ii. The Number of shares outstanding" shall be obtained by subtracting the number of own ordinary shares held by the Company as of the base date, if any, or the day one month before the Application Date in other cases from the total number of the ordinary shares issued as of such date.

iii. In the event that the Company disposes of its treasury shares, the Number of shares newly issued" shall be deemed to be replaced with the Number of treasury shares to be disposed of."

- (2)The date on which the Exercise Value after adjustment applies is stipulated as follows.

(i) If adjusted in accordance with (1) (i) above, the Exercise Value after adjustment shall apply on and after the following day of the base date (or on and after the effective date if no base date is set) in the case of a share split, or on and after the effective date in the case of a consolidation of shares. However, in the event that a share split is conducted under the condition that a proposal to decrease surplus and increase capital stock or legal capital surplus is approved at a General Meeting of Shareholders, and a date before the date of conclusion of the General Meeting of Shareholders is set as the base date of the share split, the Exercise Value after adjustment shall retroactively apply on the following day of such a base date, on and after the following day of the conclusion date of the General Meeting of Shareholders.

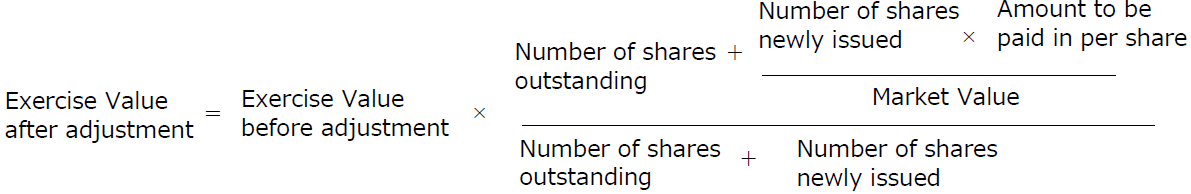

Further, in the case set forth in the preceding proviso, the ordinary shares of the Company shall be delivered to a holder of stock acquisition rights who has exercised stock acquisition rights during the period from the following day of the base date of a share split to the date of conclusion of the General Meeting of Shareholders according to the following formula (the number of shares to be delivered upon exercise of such stock acquisition rights is hereinafter referred to as the "Number of Shares Exercised before a share split"). Any fraction less than one (1) share resulting from this adjustment shall be rounded down.

(ii) The Exercise Value after adjustment adjusted in accordance with (1) (ii) above shall apply on and after the following day of the payment due date (the last day of the payment period if such a period is set) of issuance or disposal (on and after the following day of the base date if such a date is set).

- (3)In addition to the case stipulated in (1) (i) and (ii) above, in the event that the Company conducts a merger, a company split or a share exchange after the Allotment Date, and in any event equivalent to these in which it becomes necessary to adjust the Exercise Value, the Company may make the adjustment that the Board of Directors deems necessary.

-

- (7)Calculation method of the amount to be paid in for stock acquisition rights

(i) Directors of the Company

The amount to be paid in for each of the stock acquisition rights shall be an amount stipulated by the Board of Directors based on the amount calculated by the Black-Scholes model on the Allotment Date. The amount shall be the fair value of stock acquisition rights. Pursuant to the provisions of Article 246, paragraph 2 of the Companies Act, the payment obligation shall offset remuneration receivable from the Company owned by Directors.(ii) Executive Officers and employees of the Company, and directors of subsidiaries of the Company

Payment of money in exchange for stock acquisition rights shall not be required. Stock acquisition rights are fairly issued and granted as the consideration for execution of duties and do not fall under issuance with advantageous terms and conditions. - (8)Period during which stock acquisition rights may be exercised

From January 10, 2018 to October 28, 2020

- (9)Terms and conditions for exercising stock acquisition rights

- (1)Terms and conditions for respective segment of persons

(i) Directors of the Company

Holders of stock acquisition rights are required to have the rank of Director of the Company at the time of exercising the stock acquisition rights; provided, however, that this shall not apply to holders of stock acquisition rights who no longer have the rank of Director due to retirement at the expiration of the period in office or due to resignation at the request of the Company.(ii) Executive Officers and employees of the Company, and directors of subsidiaries of the Company

Holders of stock acquisition rights are required to have either the rank of Director, Audit & Supervisory Board Member, Executive Officer, or employee of the Company or a subsidiary of the Company; provided, however, that this shall not apply to holders of stock acquisition rights who no longer have the rank of Director or Audit & Supervisory Board Member of the Company or a subsidiary of the Company due to retirement at the expiration of the period in office, or who no longer have the rank of Executive Officer or employee of the Company or a subsidiary of the Company due to retirement at mandatory age. In addition, this shall not apply in the event that persons with the rank of Director, Audit & Supervisory Board Member, Executive Officer, or employee of the Company or a subsidiary of the Company lose such a rank based on justifiable grounds. - (2)Terms and conditions for all the holders of stock acquisition rights

(i) Inheritance of stock acquisition rights shall not be permitted.

(ii) Pledging of stock acquisition rights or any other disposition shall not be permitted.

- (1)Terms and conditions for respective segment of persons

- (10) Matters regarding capital stock and legal capital surplus to be increased by issuing shares upon exercise of stock acquisition rights

(i) The amount of increase of capital stock through issuing shares upon exercise of stock acquisition rights shall be half of the upper limit of capital stock, etc. stipulated in Article 17, paragraph 1 of the Ordinance on Accounting of Companies. Any fraction less than one (1) yen resulting from this calculation shall be rounded up.

(ii) The amount of increase of legal capital surplus through issuing shares upon exercise of stock acquisition rights shall be an amount obtained by subtracting the amount of capital stock to be increased stipulated in (i) above from the upper limit of capital stock, etc. described in (i) above.

- (11) Terms of acquisition of stock acquisition rights

The Company may acquire stock acquisition rights at no charge on the date stipulated separately by the Board of Directors in the event that the any of the following proposals (i) through (v) is approved by a General Meeting of Shareholders (or resolution is made by the Board of Directors or by Executive Officers who are delegated such a decision pursuant to the provisions of Article 416, paragraph 4 of the Companies Act, if the resolution of the General Meeting of Shareholders is not required).

(i) Proposal for approval of a merger agreement under which the Company becomes an absorbed company

(ii) Proposal for approval of a company split agreement or plan under which the Company becomes a split company

(iii) Proposal for approval of a share exchange agreement or share transfer plan under which the Company becomes a wholly-owned company

(iv) Proposal for approval to change the relevant provisions of the Articles of Incorporation of the Company which stipulate that approval by the Company is required for share transfer of all kinds of shares of the Company

(v) Proposal for approval to change the relevant provisions of the Articles of Incorporation of the Company which stipulate that approval by the Company is required for share transfer of the shares underling stock acquisition rights, or that the Company may obtain all of the said shares by the resolution of the General Meeting of Shareholders.

- (12) Restriction on transfer of stock acquisition rights

Any acquisition of the stock acquisition rights by transfer shall be subject to the approval of the Board of Directors.

- (13) Matters regarding delivery of stock acquisition rights associated with organizational restructuring

In the event that the Company conducts a merger (limited to the case where the Company is to be absorbed as a result of the merger), an absorption-type company split or incorporation-type company split (limited to the case where the Company is to be a split company in both company splits), a share exchange or a share transfer (limited to the case where the Company is to be a wholly-owned company in both types of restructuring) (collectively "Organizational Restructuring"), the stock acquisition rights of a company listed in Article 236, paragraph 1, item 8 (a) through (e) of the Companies Act (the "Reorganized Company") shall be delivered respectively to a holder of stock acquisition rights who owns the remaining unexercised stock acquisition rights (the "Remaining Stock Acquisition Rights") immediately before the date when Organizational Restructuring takes effect (the date when an absorption-type merger takes effect, the date when a stock company is incorporated through an incorporation-type merger, the date when an absorption-type company split takes effect, the date when a stock company is incorporated through an incorporation-type company split, the date when a share exchange takes effect, or the date when a wholly owning parent company is incorporated through a share transfer; hereinafter the same), provided that such effect by which the stock acquisition rights of the Reorganized Company shall be delivered in accordance with the following items shall be stipulated in an absorption-type merger agreement, an incorporation-type merger agreement, an absorption-type company split agreement, an incorporation-type company split plan, a share exchange agreement, or a share transfer plan.

(i) Number of stock acquisition rights of the Reorganized Company to be delivered

The number of stock acquisition rights of the Reorganized Company to be delivered shall equal the number of the Remaining Stock Acquisition Rights held by the holders of stock acquisition rights.(ii) Class of shares delivered upon exercise of stock acquisition rights of the Reorganized Company

The class of shares shall be ordinary shares of the Reorganized Company.(iii) Number of shares delivered upon exercise of stock acquisition rights of the Reorganized Company

The number of shares shall be determined in accordance with (4), taking into account conditions of the Organizational Restructuring, etc.(iv) Value of property to be contributed upon exercise of stock acquisition rights

The value of property to be contributed upon exercise of each of the stock acquisition rights to be delivered shall be an amount obtained by multiplying the Exercise Value after Organizational Restructuring, which is obtained by adjusting the Exercise Value stipulated in (5) in consideration of conditions of the Organizational Restructuring, etc., by the number of shares delivered upon exercise of stock acquisition rights of the Reorganized Company, which shall be determined in accordance with (iii) above.(v) Period during which stock acquisition rights may be exercised

The period during which stock acquisition rights may be exercised shall start on either the commencing date of the exercisable period of stock acquisition rights stipulated in (8) or the effective date of the Organizational Restructuring, whichever is later, and end on the expiration date of the exercisable period of stock acquisition rights stipulated in (8).(vi) Matters regarding amount of increase of capital stock and legal capital surplus through issuing shares upon exercise of stock acquisition rights

Matters regarding capital stock and legal capital surplus to be increased shall be determined in accordance with (10).(vii) Restriction on acquisition of stock acquisition rights by transfer

Any acquisition of stock acquisition rights by transfer shall be subject to the approval of the Board of Directors of the Reorganized Company.(viii) Terms and conditions for exercising stock acquisition rights

Terms and conditions for exercising stock acquisition rights shall be determined in accordance with (9).(ix) Terms of acquisition of stock acquisition rights

The terms of acquisition of stock acquisition rights shall be determined in accordance with (11). - (14) Handling of fractions less than one (1) share resulting from exercise of stock acquisition rights

If the number of shares to be delivered to a stock acquisition right holder upon exercise of stock acquisition rights produces a fractional number less than one (1) share, such fractional number shall be rounded down.

- (15) Allotment Date of stock acquisition rights

November 26, 2015

- (16) Place where exercise request of stock acquisition rights is accepted

Administration and HR Department of the Company (or the department that is in charge of the relevant operations of the time)

- (17) Place where the money to be contributed upon exercise of stock acquisition rights is paid

Mizuho Bank, Ltd. Yokoyamacho Branch (or a bank which inherits Mizuho Bank or a branch which inherits Yokoyamacho Branch)

- (18) Handling of stock acquisition right certificates if issued

Stock acquisition right certificates shall not be issued.

- (1)Name of stock acquisition rights

End