Long-Term Vision, Medium-Term Management Plan

Background of Formulation

The business environment surrounding the Group has become increasingly uncertain amid revolutionary changes, including the escalation of climate change issues, the emergence of geopolitical risks, the declining birthrate and the aging of society in Japan, the acceleration of behavioral changes triggered by the COVID-19 pandemic, and rapid advances in digital technology. In order to adapt to such changes in the business environment, ensure the Group's continued growth over the future, and enhance corporate value by contributing to the realization of a sustainable society, the Company formulated "Tosei Group Long-Term Vision 2032" to clarify "the Company's direction (what the Company envisions to be)" based on the Company's core competencies that are the source of the Group's competitive advantage and to make Group-wide efforts to realize its vision.

The Company formulated the new medium-term management plan "Further Evolution 2026" for the initial three years (phase 1) out of the nine-year period in order to realize the Long-Term Vision 2032.

Tosei Group Long-Term Vision 2032

Overview of the "Tosei Group Long-Term Vision 2032"

The Group, through its six real estate-related businesses, has provided various solutions to realize the potential value of real estate. The Company is also expanding the business domain while mitigating risks by combining multiple businesses with different business attributes and are continuing to improve its real estate investment technique as a portfolio manager capable of handling a wide variety of assets. Furthermore, in the asset management domain, the Company offers world-class services trusted by real estate investors around the world and will work toward growing its business and realizing the Long-Term Vision 2032 by further expanding the Company's core competencies, i.e., the Company's "Real Estate Solution Capabilities," "Portfolio Management Capabilities," and "Global Reach Capabilities".

Medium-Term Management Plan "Further Evolution 2026"

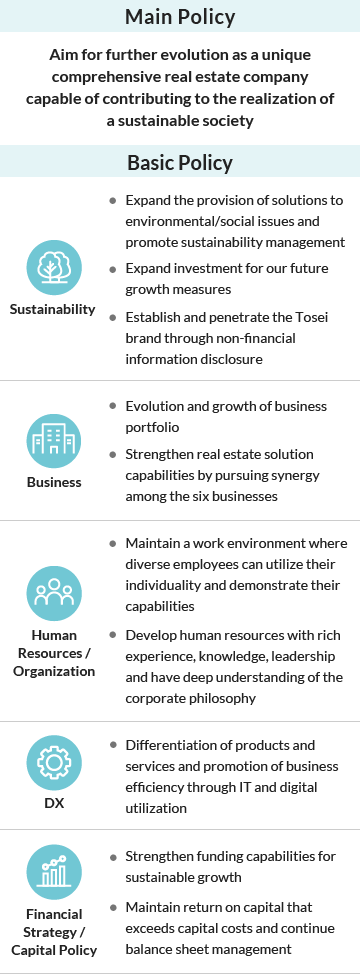

Main Policy and Basic Policies

By executing various measures under the following main policy and five basic policies, the Company will enhance the competitive edge of the Group and also contribute to the realization of a sustainable society.

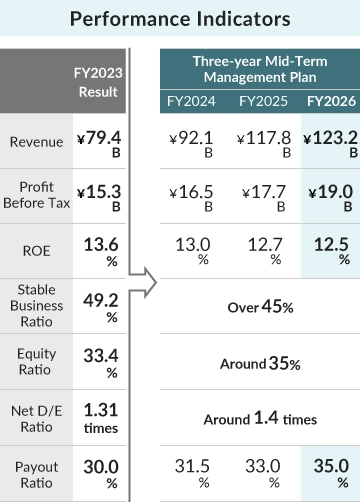

Target management indicators

-

*As of January 12, 2024

Specific Initiatives

The plan will aim for the evolution and growth of the six existing business portfolio by strengthening "Real Estate Solution Capabilities", "Portfolio Management Capabilities", and "Global Reach Capabilities", which are the sources of the Group's corporate value, and expanding the service domains of each business and maximizing synergies within the Group.

In the Revitalization Business and the Development Business, the Company will aim to establish and penetrate the Tosei brand through differentiation by providing environmentally-friendly products conscious of sustainability, encouraging the utilization of existing real estate stock, and expanding the scope of products handled, among others. Additionally, to enhance its purchasing competitiveness, the Company will promote studies to improve the efficiency of property appraisals and the utilization of M&As.

In Stable Business, the Company will work on the studies of facility specifications in line with tenant demand in the Rental Business and the reinforcement of its service functions and the improved efficiency of back office operations in the Fund and Consulting Business and the Property Management Business, and make efforts to penetrate the Company's brand through appeal to customers by differentiating the Tosei Hotel COCONE from other hotels and expand scales in the Hotel Business.

Furthermore, in the DX field, the Company will make efforts to promote business efficiency, while also providing real estate investment opportunities to a new customer base through real estate crowd funding, a real estate tech business which combines real estate, finance, and DX, issuing security tokens, and digital matching of the sales of existing condominium units, in order to diversify the exit strategies for properties revitalized and developed by the Company.

To strengthen the Company's business base that sustains growth, it will focus its efforts on the building of a personnel system, organizational structure, and work environment that allows for human resources development and enables diverse employees to leverage their individuality and maximize their capabilities and deepen its engagement with the employees. Additionally, in terms of finances and capital allocation, the Company will strengthen its funding capabilities to support the expansion of its business scale and the balance of assets held, while maintaining a sound financial structure and aiming to continue its growth investment and improvement of the return of profits with an awareness of capital efficiency.

Review of the Medium-term Management Plan "Infinite Potential 2023"

Basic Policies

Pursue the Group's infinite growth potential in all aspects of real estate and aim for

a new stage as a comprehensive real estate company.

Fundamental Policy

|

Growth Strategy |

|

|---|---|

|

Strengthen the Business Base |

|

In the previous medium-term management plan, "Infinite Potential 2023" (from December 2020 to November 2023), upheld the main policy of "Pursue the Group's infinite growth potential in all aspects of real estate and aim for a new stage as a comprehensive real estate company," the Company pursued such initiatives as the expansion of existing businesses with a focus on environmental and social issues as well as the enhancement of existing businesses through the promotion of DX while putting sustainability management into practice.

The plan commenced in FY2021, a year when there was no end in sight to the COVID-19 pandemic. Still, as a result of unwavering efforts to recover business performance and promote growth measures, we managed to achieve record profits in FY2022. In the final fiscal year of the plan, we once again achieved record profits as well as an ROE of 13.6% exceeding the ROE of 12%, which had been targeted in the final fiscal year.

Performance against target management indicators are as follows.

Target values

Scroll

|

Target values |

First Fiscal Year |

2nd Year |

3rd Year (final year) |

|---|---|---|---|

|

Consolidated revenue |

¥69.5B |

¥80B |

¥85B |

|

Consolidated |

¥8B |

¥12B |

¥14B |

|

ROE for the final fiscal year of the plan |

- |

- |

Over 12% |

|

Stable Business Ratio |

47.5% |

43.5% |

Over 42% |

|

Equity Ratio |

35.7% |

33.3% |

About 35% |

|

Net D/E Ratio |

1.01 times |

1.35 times |

About 1.3 times |

|

Payout Ratio |

26.2% |

28.2% |

30.2% |

Actual values

Scroll

|

Actual results |

First Fiscal Year |

2nd Year |

3rd Year (final year) |

|---|---|---|---|

|

Consolidated revenue |

¥61.7B |

¥70.9B |

¥79.4B |

|

Consolidated |

¥10.3B |

¥12.7B |

¥15.3B |

|

ROE |

10.8% |

12.5% |

13.6% |

|

Stable Business Ratio |

40.7% |

43.0% |

49.2% |

|

Equity Ratio |

33.8% |

34.3% |

33.4% |

|

Net D/E Ratio |

1.23 times |

1.29 times |

1.31 times |

|

Payout Ratio |

26.7% |

28.1% |

30.0% |