Disclosure Based on TCFD Recommendations

Supporting the Recommendations of the Task Force on Climate-related Financial Disclosures (TCFD)

In November 2021, we endorsed the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) and joined the Japan TCFD Consortium. Based on the TCFD recommendations, we will analyze the risks and opportunities posed by climate change to our business, and strive to further enhance climate-related information disclosure.

Note: Task Force on Climate-related Financial Disclosures (TCFD) has fulfilled its remit and disbanded on October 12, 2023. The monitoring function on the progress of companies' climate-related disclosures is handed over to the IFRS Foundation, who are responsible for the formulation of the International Financial Reporting Standards.

-

*Progress after September 28, 2022 is reported as needed on the "Climate Change" page.

Core Elements of Recommended Climate-related Financial Disclosures by TCFD

This document discloses climate-related information base on the four thematic areas recommended by the TCFD.

|

Governance |

The organization's governance around climate-related risks and opportunities |

|---|---|

|

Strategy |

The actual and potential impacts of climate-related risks and opportunities on the organization's businesses, strategy, and financial planning |

|

Risk Management |

The processes used by the organization to identify, assess, and manage climate-related risks |

|

Metrics and Targets |

The metrics and targets used to assess and manage relevant climate-related risks and opportunities |

Governance

Organization Framework

Tosei Group has established the Sustainability Committee, which reports directly to the Board of Directors, to promote ESG management practices that take sustainability into account. Based on the Tosei Group ESG Policy and ESG Action Guidelines, the Sustainability Committee formulates policies to improve the Group's overall sustainability, including addressing climate change, formulates annual activity plans for ESG promotion, monitors, provides advice and guidance the progress of each measures and departmental activities.

The Sustainability Committee is chaired by the Sustainability promotion director (Noboru Hirano, CFO and Senior Executive Officer) appointed by the President and CEO, and consists of members appointed by the director. In principle, the committee holds six meeting a year, and its deliberations, activity status, and reported matters are reported monthly to the Board of Directors.

The Sustainability Committee identifies, classifies, analyzes, and evaluates risks and opportunities, and formulates organizational measures and response plans for adaptation and mitigation for climate-related risks in accordance with the Regulations for Risk Management Related to Climate Change. The measures approved by the Board of Directors are linked to business strategies under the leadership of the Sustainability Committee and are directed to the Group companies and their respective business units.

Role of the Board of Directors

The Board of Directors has the highest responsibility for climate change-related risk management, and shall establish the necessary organizational structure, appropriately supervise it, and provide instructions as necessary. In addition, based on reports from the Sustainability Committee, the Board of Directors appropriately monitors and supervises the progress of each measure and program, reviewing the policies and directing improvements to the promotion system as necessary. In addition, ESG promotion targets, including climate change, are set as items for evaluation and reward of full-time directors in charge of ESG.

|

Management and |

Board of Directors |

|---|---|

|

Person in Charge |

Person responsible for climate change-related risk management: Noboru Hirano, CFO and Senior Executive Officer of Administrative Division

|

|

Secretariat |

Corporate Planning Department |

Strategy

To understand the possible impact of future climate change on our group's business and to reflect such impact into our business strategy, we chose multiple future climate change scenarios defined by international institutions and identified risks and opportunities of the hypothetical world under each scenario. The details of the scenario analysis are as follows.

Determining Targets for the Analysis

In this scenario analysis, all our group's businesses are included as the target. Regarding the possible impact on real estate holdings, the analysis covers office buildings, commercial facilities, detached houses, apartment buildings, hotels, and logistics facilities as asset classes that are expected to be strongly affected by climate change, while existing condominiums units, which have a small impact, were excluded from the analysis.

Determining Time Frames for the Analysis

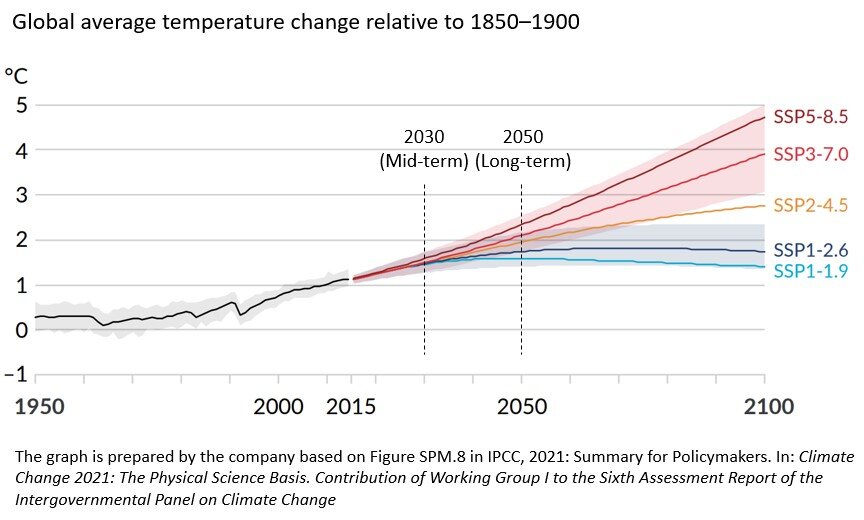

In analyzing the scenarios, we used 2030 (medium-term) and 2050 (long-term) as time frames for the scenario analysis, considering the effects of climate change assumed in each scenario parameter will materialize in the medium to long term.

Assumptions Underlying Each Scenario

The TCFD recommendations advise the use of several scenarios, including a 2°C or lower scenario, to examine the resilience of the organization in an uncertain future.

Our group used the following two scenarios for our study and analysis.

- (1)1.5°C-2°C increase scenario (high transition risks, low physical risks)

- Under this scenario in which regulations and policies are strengthened for decarbonization, measures to address climate change are taken, and temperature rise is expected to be around 1.5 -2°C in 2100.

Companies are strongly required to respond to climate change, and if they do not, customer outflow and reputation risks will increase, resulting in higher transition risks, while physical risks will be relatively low, as the severity and increase of disasters caused by climate change will be suppressed into a certain extent. - (2)4°C increase scenario (low transition risks, high physical risks)

- Under this scenario in which climate change measures are not adequately addressed and temperatures rise from pre-industrial levels to about 4°C by 2100.

Physical risks are assumed to increase, including more severe natural disasters, sea level rise, and an increase in extreme weather events.

This will increase the competitiveness of products and services with superior BCPs. On the other hand, transition risks will be lower, as government regulations will not be strengthened.

Mainly Referenced Scenario Parameters

Scroll

|

Institutions / Organizations |

1.5 - 2°C Scenario |

4°C Scenario |

|

|---|---|---|---|

|

Transition Risks |

IEA (International Energy Agency) |

|

- |

|

Physical Risks |

IPCC (Intergovernmental Panel on Climate Change) |

|

|

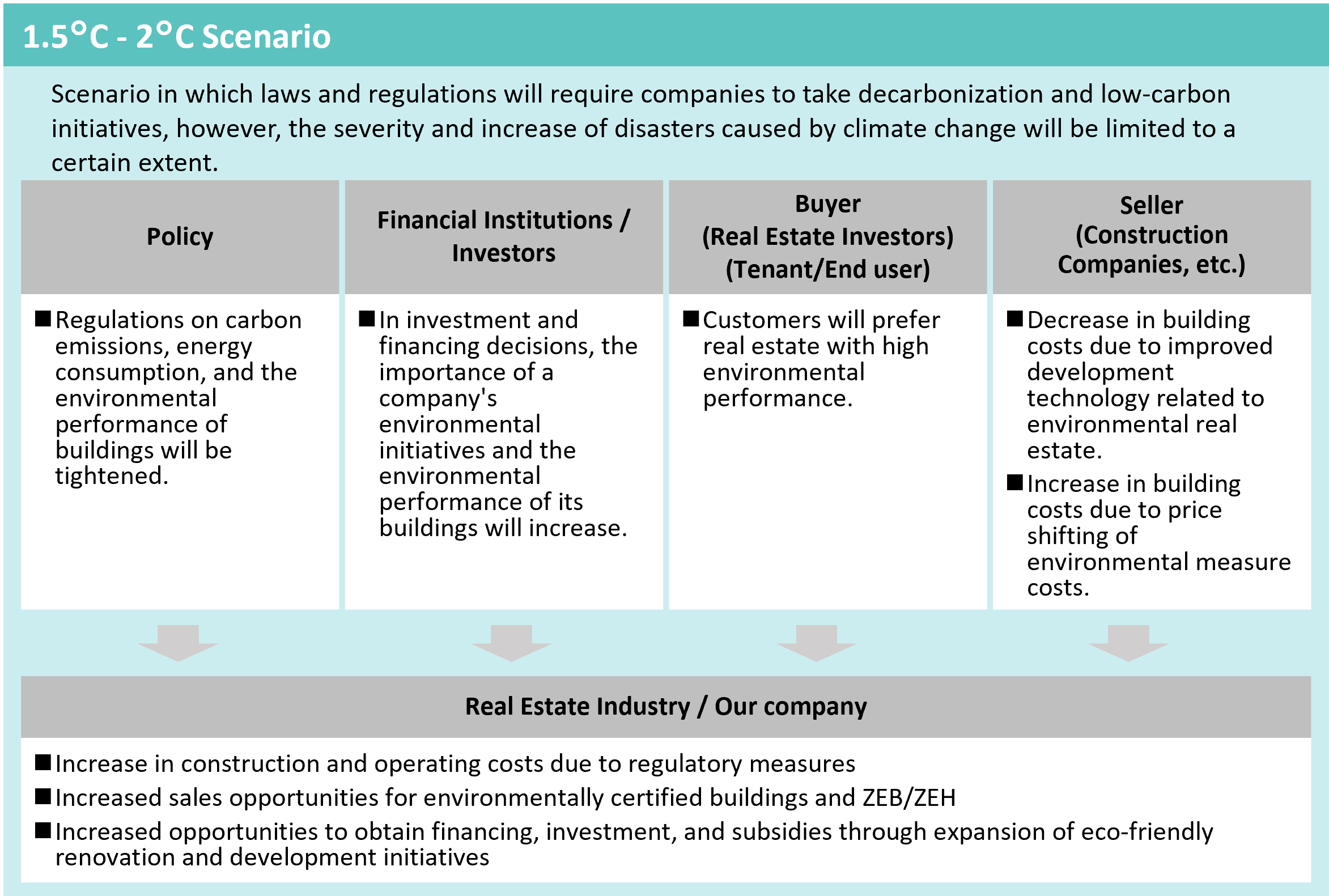

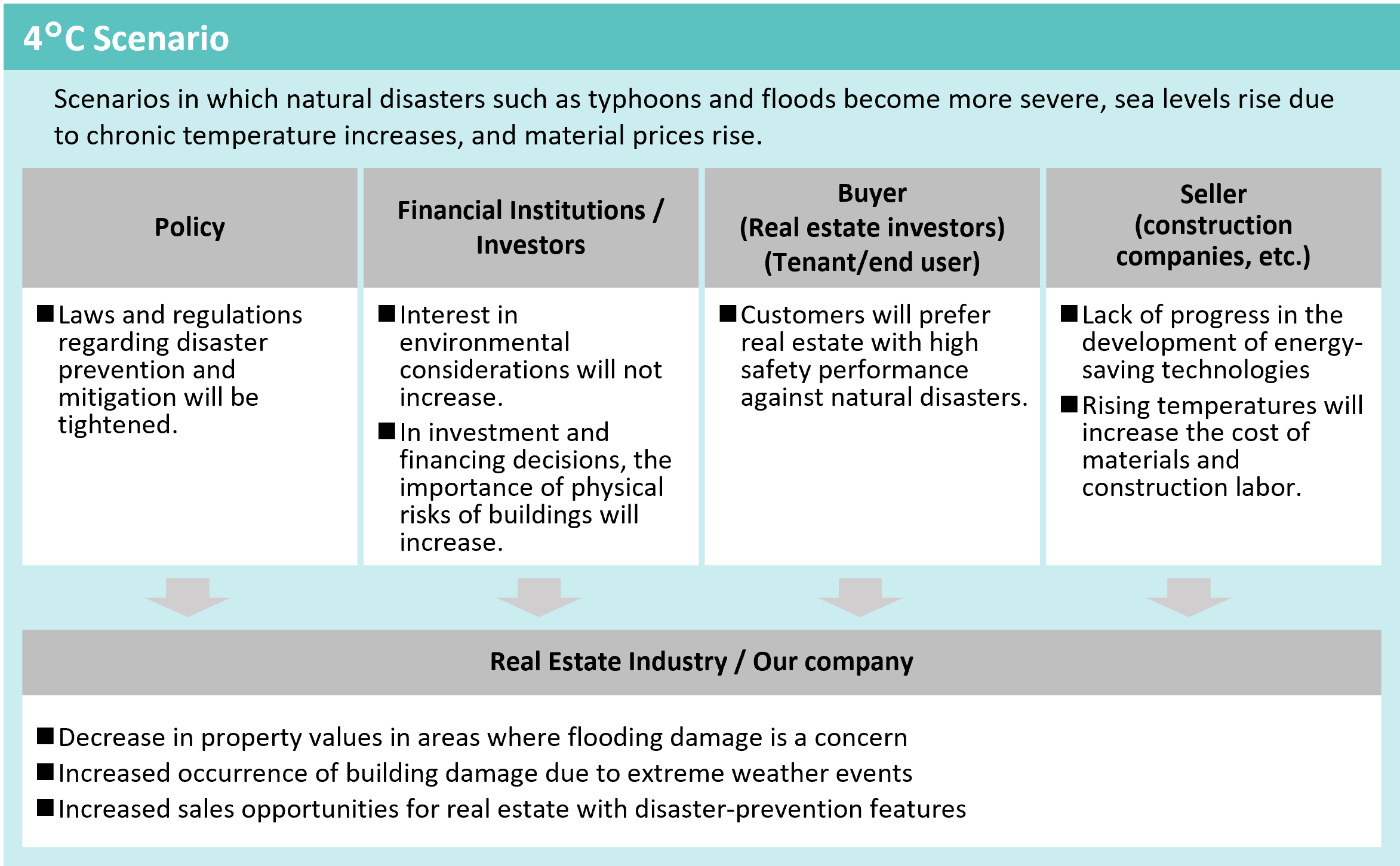

Future World View of Each Scenario

Identification of Risks / Opportunities Based on Scenario Analysis and Evaluation of Financial Impact

Based on the two climate-related risks and opportunities (Transition risks / opportunities and Physical risks / opportunities) categorized in the TCFD recommendations, we have identified the major risks and opportunities that are expected to have a significant impact on our business for each scenario. For each of the identified risks and opportunities, we evaluated the financial impact using parameters published by international organizations. The degree of impact on the Group was assessed on a four-point scale (major, medium, minor, and minimal) based on the materiality standards of the Tokyo Stock Exchange for timely disclosure, qualitative judgments take into account. Details are as follows.

Transition Risks / Opportunities

scroll

| Category | Item / Contents | Time Frame | Financial Impact | |

|---|---|---|---|---|

| 1.5 - 2°C Scenario | 4°C Scenario | |||

| Regulation / Policy |

Introduction of carbon tax

|

Mid to Long term | Minimal | Minimal |

Tighter GHG emission regulations

|

Mid to Long term | Medium | Minor | |

Mandatory of Energy Efficiency Labeling System

|

Mid to Long term | Medium | Minimal | |

-

*Financial impact is calculated based on internal data available as of June 2024.

Resilience of the Group and the Results of the Analysis

Results of the scenario analysis indicate that the financial impact on the Group from transition risks, especially in the "medium to long term" time frame, will emerge as a result of changes in the social transformation associated with the transition to a decarbonized society (1.5°C - 2°C Scenario), specifically through the tightening of various government regulations (adoption of carbon taxes, mandatory ZEH / ZEB levels, mandatory energy efficient labeling, etc.), and changes in the behavior and preferences of investors and financial institutions.

The Group will shift to using electricity generated from renewable energy sources for its head office and own-operated hotels. We will also promote internal resource and energy conservation efforts to reduce the Group's GHG emissions. Moreover, we will work together and cooperate with suppliers and contractors to reduce GHG emissions during construction as well as to promote ZEH / ZEB in new development projects, renovate existing real estate to environmentally friendly real estate specifications, acquire environmental real estate certifications, and raise awareness among the tenants. Through such efforts, we aim to reduce GHG emissions throughout the value chain and minimize risks and maximize opportunities.

Physical Risks / Opportunities

scroll

| Category | Item / Contents | Time Frame | Financial Impact | |

|---|---|---|---|---|

| 1.5 - 2°C Scenario | 4°C Scenario | |||

| Acute | Increased severity of extreme weather events

|

Short to Mid term | Minimal | Medium |

| Chronic | Sea Level Rise

|

Mid to Long term | Minimal | Minimal |

Decline of Labor Productivity

|

Short to Long term | Minimal | Minor | |

Supply Chain Confusion

|

Mid to Long term | Minimal | Medium | |

-

*Financial impact is calculated based on internal data available as of June 2024.

Resilience of the Group and the Results of the Analysis

Results of the scenario analysis indicate that financial impact from physical risks on the Group, especially in the "medium to long term" time frame, will emerge as a result of intensifying extreme weather events in society where climate change measures are not sufficiently implemented (4°C Scenario) and supply chain confusion.

Upon acquisition, we make investment decisions only after comprehensively considering various factors, including flood risks. Also, we regularly check the risk status of our property portfolio using hazard maps, and take appropriate business continuity planning (BCP) measures such as reviewing the portfolio and purchasing insurance. Through these efforts, we aim to minimize risks while maximizing opportunities.

Furthermore, we will work together and cooperate with suppliers and contractors to strengthen the supply chain and improve health and safety, and productivity at construction sites.

Strategies and Measures Developed Based on the Results of Scenario Analysis

Considering the aforementioned scenario analysis results, the Group will promote and consider the following measures in its management strategy and financial plan to minimize risks and maximize opportunities.

-

Reduction of CO2 emission through revitalization business

-

Utilization of renewable energy

-

Initiatives to reduce GHG emissions in the real estate fund and consulting business

-

Development of decarbonized / low-carbon properties

-

Promotion of LED installation in existing buildings

Risk Management

Process for Identifying and Assessing Climate-related Risks and Opportunities

The Sustainability Committee, responsible for risk management related to climate change, conducts regular group-wide surveillance once a year and identifies climate-related risks and opportunities based on the results. The identified climate-related risks and opportunities are evaluated on two scales, "likelihood" and "impact" based on multiple assumptions (scenarios) about future climate change defined by international organizations and others. The results of the analysis are reported to the Board of Directors each time they are performed. Climate-related risks and opportunities in this analysis are based on the following definitions.

1. Transition Risks

Risks associated with the transition to a low-carbon society, which are risks brought about by changes in policies and legal regulations to address climate change, as well as changes in technological development, market trends, market valuations, etc.

|

(ⅰ)Current Regulations (Policy and Legal) |

Risks related to policy actions that attempt to constrain actions that contribute to the adverse effects of climate change |

|---|---|

|

(ⅱ)New Regulations (Policy and Legal) |

Risks related to policy actions that seek to promote adaptation to climate change |

|

(ⅲ)Technology |

Risks related to technology that may change or evolve with climate change among suppliers of materials and services related to each of the Group's businesses |

|

(ⅳ)litigation |

Risks related to climate-related litigation claims being brought before courts |

|

(ⅴ)Market |

Risks associated with changes in the markets relevant to the business of the Group companies as society transitions to a low-carbon and decarbonized society in relation to climate change |

|

(ⅵ)Reputation |

Risk of changes in the Group' s reputation with customers, investors, various suppliers, communities, governments, and others related to the Group in relation to climate change |

2. Physical Risks

Risk of exposure to acute or chronic damage from climate change and other causes brought about by climate change.

3. Opportunity

|

(ⅰ)Resource Efficiency |

Opportunities related to improving resource efficiency in the business activities of our Group |

|---|---|

|

(ⅱ)Energy Source |

opportunities from shifting to low-carbon energy sources to meet the energy needs of our group companies' business activities |

|

(ⅲ)Products and Services |

opportunities arising from low-carbon and climate change adaptive products and services of our group companies |

|

(ⅳ)Market |

opportunities for our Group to enter new markets as we transition to a low-carbon economy |

|

(ⅴ)Resilience |

opportunities arising from enhancing various adaptive capacities of our group companies to cope with climate change |

Processes to Manage Climate-related Risks and Opportunities

Of the identified risks and opportunities, the Sustainability Committee creates a plan for each element that the Tosei Group should address in an organized manner, and the Board of Directors approves the plan. The plan is formulated based on the basic framework of risk management, namely "avoidance," "acceptance," "mitigation," and "transfer."

Under the supervision of the Board of Directors and in accordance with the instructions of the Sustainability Committee, the approved risk response plans are implemented by the respective business operation systems of Tosei and its group companies. The Sustainability Committee also takes the lead in linking the risk management plan to the business strategy by providing instructions to each Group company and their respective business organizations.

Status of Company-wide Risk Management Integration

The Risk and Compliance Committee, which is a committee directly under the Board of Directors, is responsible for centralized and cross-sectional risk management of the Tosei Group. The committee is responsible for implementing basic measures for the Group's risk management, responding to management crises that may occur as risks emerge, and overseeing and managing the various risks surrounding the Group's businesses.

Climate change risks and opportunities, which are of particular importance among the company-wide risks and should manage following the framework recommended by the TCFD, are led by the Sustainability Committee under the supervision of the Board of Directors. The Risk and Compliance Committee ensure the integrated Enterprise Risk Management by assisting and supporting the Sustainability Committee in its implementation of various measures.

Metrics and Targets

Disclosure Elements of Greenhouse Gas (GHG) Reduction Target

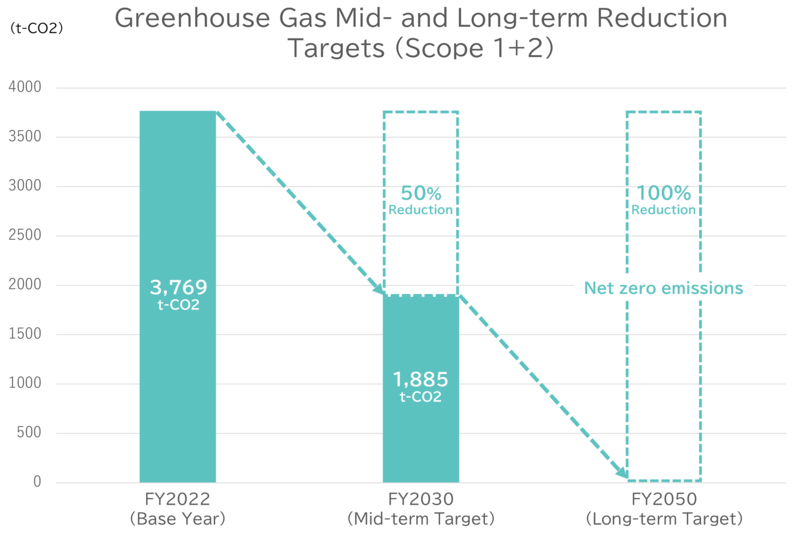

The Tosei Group has set the goal of achieving net-zero greenhouse gas emissions in Scope 1 and 2 in FY2050 to keep the global temperature increase below 1.5°C. In addition, the Company will pursue the following reduction targets over the medium term, with FY2022 as the base year.

|

Base Year |

FY2022(From December 2021 to November 2022) |

|---|---|

|

Reduction Target* |

Scope 1: direct emission of GHGs by business operators themselves, such as from combustion of fuel |

|

Target Year / Reduction Ratio |

Long-term Target: Net-zero by FY2050 |

-

*The GHGs emitted by our group consist of GHGs emitted directly from our company through the usage of city gas used at our headquarter, sales offices, and company-operated hotels and gasoline used in company vehicles (Scope 1), and GHGs emitted indirectly through the usage of electricity at our headquarter, sales offices, and company-operated hotels and district heat and cooling used at our headquarter office (Scope 2).

Greenhouse Gas (GHG) Emissions

Scroll

| Item [Unit] | FY2022 Results (Base year) |

FY2030 Target (Target year) |

FY2021 Results | FY2022 Results | FY2023 Results | FY2024 Results | |

|---|---|---|---|---|---|---|---|

| GHG (CO2) emissions [t-CO2] |

Scope 1 | 480 |

- | 197 | 480 |

583 |

776 |

| Scope 2 | 3,289 |

- | 1,696 | 3,289 |

2,714 |

2,485 |

|

| Scope 1+ Scope 2 Total |

3,769 |

1,885 | 1,893 | 3,769 |

3,296 |

3,261 |

|

| Reduction rate compared to base year (Scope 1+Scope 2 Total) |

- | -50% | - | - | -12.5% | -13.5% | |

| Total floor area of the subject [㎡] | 61,561 | - | 49,112 | 61,561 | 73,722 | 72,505 | |

-

*

-

*For FY2021 calculation, the Princess Group, which became a consolidated subsidiary in October 2021, is not included.

-

*The Group excludes GHGs (CFCs, etc.) other than CO2 due to their extremely small amounts, and calculates and reports only CO2.

-

*The GHG emission factor is based on the "Emission Factor by Electric Power Company" published by Ministry of the Environment and Ministry of Economy, Trade and Industry, and uses the emission factor of the electric power company used by the subject building.

-

*As of November 30, 2024