Release of Information Regarding – “TOSEI Real Estate Crowd TREC FUNDING” - “TREC No. 8 Condominium Units Fund Oedo Series II”

【To whom it may concern】

TOSEI CORPORATION

March 14, 2024

Release of Information Regarding

– "TOSEI Real Estate Crowd TREC FUNDING "-

“TREC No. 8 Condominium Units Fund Oedo Series II”

TOSEI CORPORATION (Head Office: Minato-ku, Tokyo; President and CEO: Seiichiro Yamaguchi; Securities Code: 8923) (the”TOSEI”) is pleased to announce that, on March 14, we released information regarding “TREC No. 8 Condominium Units Fund Oedo Series II” (the “Fund”) which is the eighth fund of the “TOSEI Real Estate Cloud TREC FUNDING” real estate crowdfunding though which you can make online investments in real estate. Only investors that are residents of Japan are permitted to invest in the Fund and use our services related to investing in the Fund. Investors that are non-residents of Japan are not permitted to invest in the Fund or otherwise receive our services, so we cannot accept investment requests from any investors that are non-residents of Japan.

Fund Overview

|

Fund Name: |

TREC No.8 Condominium Units Fund Oedo Series Ⅱ |

|---|---|

|

PropertyType: |

7 condominium units in total |

|

Total Amount of Fund: |

167.5 million yen |

|

Amount of Offering (Preferred Investment): |

126.5 million yen |

|

Expected Distribution Rate: |

5.0% * The dates in the boxes below are subject to change. |

|

Scheduled Operation Period: |

2 years and 6 months (April 22, 2024 - October 21, 2026) |

|

Minimum Investment Amount: |

10,000 yen (10,000 yen per unit x 1 unit) |

|

Offering Period (Scheduled): |

March 26 (Tue) 2024, 12:00 p.m. - Aprli 8 (Mon) 2024, 12:00 a.m. |

|

URL for Details: |

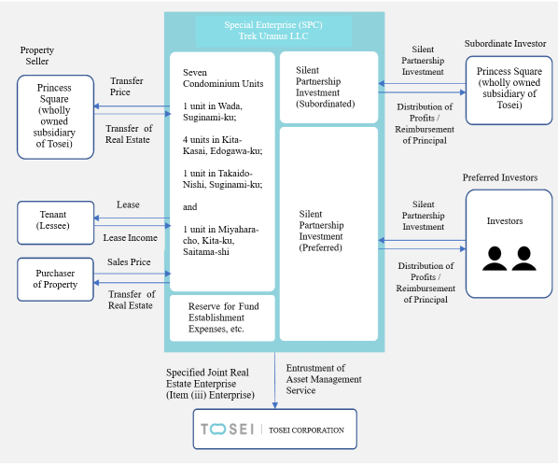

The Subject Properties are Seven Condominium Units in the Tokyo Area

The Fund will acquire and manage seven condominium units located in the Tokyo area (1 unit in Wada, Suginami-ku, 4 units in Kita-Kasai, Edogawa-ku, 1 unit in Takaido-Nishi, Suginami-ku, and 1 unit in Miyahara-cho, Kita-ku, Saitama-shi). As for the properties to be acquired, we have selected properties with layouts suitable for families and DINK couples (Double Income No Kids), the demand for which has been increasing. All of these properties are located close to facilities such as supermarkets, hospitals and parks, and offer a peaceful living environment while being convenient for daily life.

As of February 2024, 6 of the 7 units have been leased and the remaining 1 unit is vacant. The vacant property will be promptly renovated after the acquisition to improve its value as a residential condominium and is scheduled to be sold on the market within one (1) year after the commencement of management. For this reason, distribution of selling profit and partial redemption of the principal are expected to occur during the period. As for the leased properties, we will strive to improve the cash flow by reviewing the rent to an appropriate amount at the timing of renewal of lease agreement. If any of the properties become vacant, we will start sales activities after increasing the value of each such property as a residential condominium.

Through these initiatives, we aim to improve the property values, shorten the period until management are terminated (i.e., completion of the sale of all of the properties) to the extent possible, and improve the investment efficiency of the investments made by our investors.

Efforts to Improve Safety of Principal

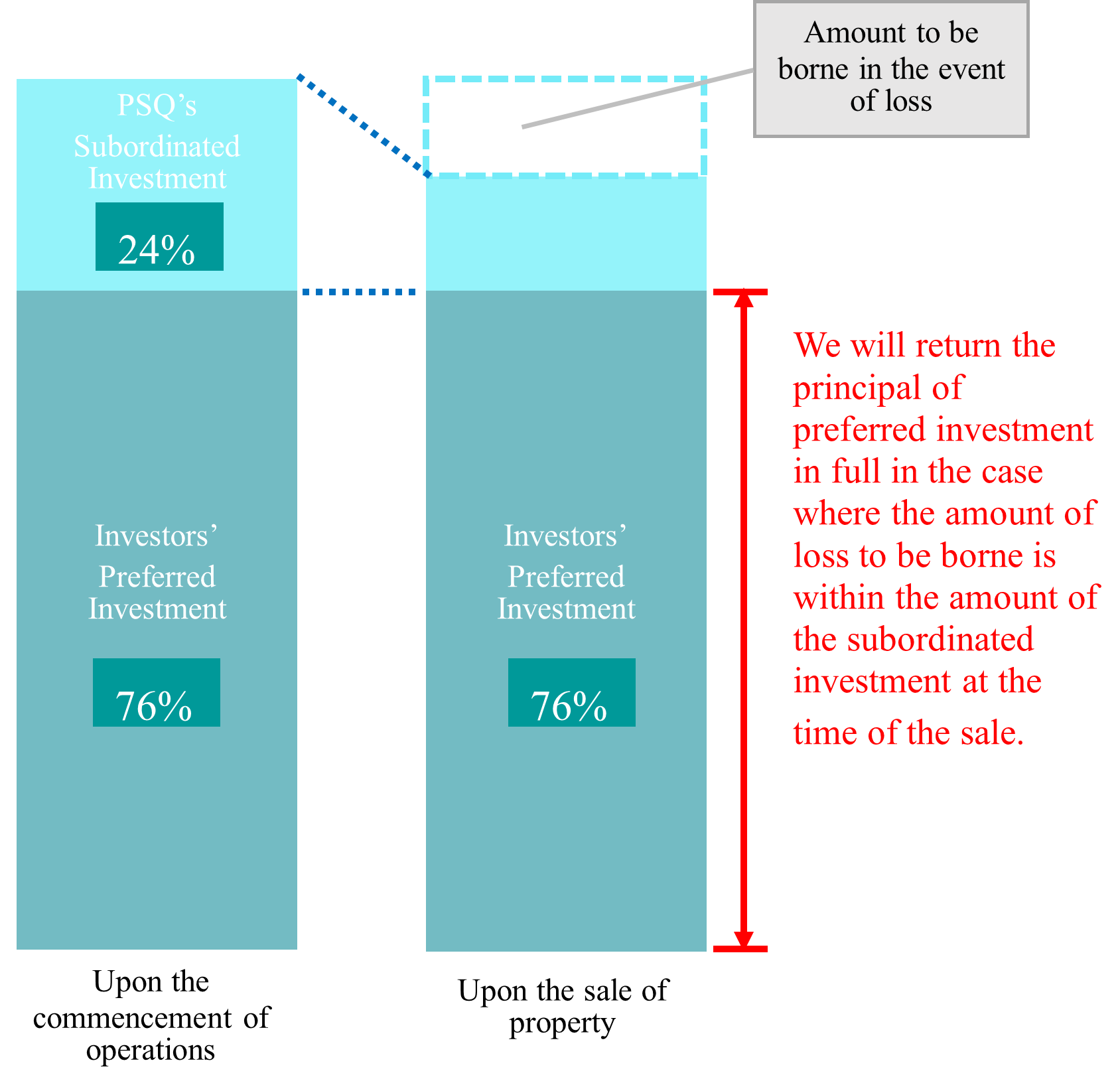

■Adoption of preferred/subordinated investment structure

With respect to the Fund, Princess Square Co., Ltd. (“PSQ”), a wholly owned subsidiary of TOSEI, will make a subordinated investment for approximately 24% of the total amount of the Fund, to thereby enhance the safety of the principal of the preferred investment made by our investors. In the event of any loss arising from the real estate management, such loss will first be borne by the subordinated investor. Therefore, if the loss is within 24%, the principal of the preferred investment will not be impaired.

On the other hand, as a result of accepting approximately 24% subordinated investment by PSQ, a special purpose company (SPC) will become a consolidated subsidiary of PSQ for accounting purposes. Accordingly, in the event that PSQ’s credit status deteriorates and PSQ commences bankruptcy proceedings, PSQ will be deemed to own the subject properties and the subject properties may be affected by such bankruptcy proceedings. Please carefully confirm and consider the details of the Fund before making an investment decision.

Preferred/Subordinated Investment Structure

■Risk Diversification through Inclusion of Multiple Properties

By incorporating multiple properties into a single fund, we aim to reduce the one-sided risks of rent income decreases and/or property price declines, to thereby ensure stable fund management.

TOSEI Real Estate Crowd TREC FUNDING will continue to strive to plan products that meet our investors’ expectations and improve our services.

Overview of TOSEI Real Estate Crowd TREC FUNDING Services

- - Website Name: TOSEI Real Estate Crowd "TREC FUNDING"

*TREC stands for “TOSEI Real Estate Crowd”

-

- Concept: Achievement and confidence in real estate business - Start real estate crowdfunding with TOSEI

- - Website URL:

- - Membership Registration URL:

*To invest via “TREC FUNDING” you need to register as a member and take the relevant bank account opening procedure, etc. Please note that there are conditions to invest via TREC FUNDING as stated at the beginning of this release.

<Tosei Corporate Data>

(As of end of November, 2023)

- Company name

- Tosei Corporation https://www.toseicorp.co.jp/english/

- President and CEO

- Seiichiro Yamaguchi

- Address

- Tamachi Tosei Bldg., 4-5-4 Shibaura, Minato-ku, Tokyo

- Capital

- 6,624,890 thousand yen

- Employees

- 727(Consolidated)、268(Non-Consolidated)

- Fields of business

- Revitalization; Development; Rental; Fund and Consulting;Property Management; Hotel

Contact

Public Relations・Sustainability Promotion Section,

Corporate Management Department, Tosei Corporation

+81-3-5439-8807

[Indications under the Financial Instruments and Exchange Act, and the Real Estate Specified Joint Enterprise Act]

1. Trade Name, Registration Number and Memberships

Trade Name: TOSEI CORPORATION

Financial Instruments Business Registration No.: Director-General of Kanto Local Finance Bureau (Financial Instruments) No. 898

Type of Financial Instruments Business: Type II Financial Instruments Business; Investment Advisory and Agency Business

Memberships: Type II Financial Instruments Firms Association; Japan Investment Advisors Association

Real Estate Specified Joint Enterprise Operator License No.: Commissioner of the Financial Services Agency, Minister of Land, Infrastructure, Transport and Tourism No. 102

Type of Real Estate Specified Joint Enterprise : Item (i) Enterprise; Item (iii) Enterprise; Item (iv) Enterprise (The Items (i) and Item (iv) Enterprise include Electronic Trading Services)

Representative: Seiichiro Yamaguchi, President and CEO

Business Manager: Hitoshi Ohshima, Service Manager, Head Office

2. Investment Risks and Fees

Neither yield nor principal is guaranteed for the equity in any investment in a silent partnership that we handle in this service, and there are risks, such as a loss of the principal of the investment. In principle, the equity of an investment in a silent partnership cannot be transferred to a third party or cancelled unless there are unavoidable circumstances. Therefore, it is possible that you will not be able to transfer or cancel the equity of your investment in a silent partnership at the time of your request and therefore cannot convert the same into cash. The fees and risks will vary depending on the fund. For more details, please refer to the details of each fund on our website and the Documents Prior to the Conclusion of a Contract that are to be delivered.

3. Type of Real Estate Specified Joint Enterprise Contract and Manner of Transaction

Type of Contract: Contract as set forth in Article 2, Paragraph (3), Item (ii) of the Real Estate Specified Joint Enterprise Act.

Manner of Transaction: Treatment of offering (acting as an agent or intermediary in concluding a Real Estate Specified Joint Enterpris Contract to which a Special Enterprise is a party)

|

*The Japanese version of this website shall be the original, and this English version has been prepared for reference purposes only. In the event of any discrepancy or inconsistency between these two versions, the Japanese version shall prevail (provided, however, that this shall not apply to any discrepancy or inconsistency for any matter relating to the scope of investors or the scope of provision of our services first written above). |