Climate Change

- The Company's Perceptions of Climate Change Issues

- Supporting the Recommendations of the Task Force on Climate-related Financial Disclosures (TCFD)

- Governance

- Strategy

- Risk Management

- Metrics and Targets

- Disclosure Based on TCFD Recommendations(PDF)

The Company's Perceptions of Climate Change Issues

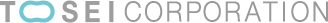

Since the Paris Agreement of 2015, climate change has become an urgent global challenge, and the need to address environmental issues has become a common understanding among countries around the world. The current climate system and the scale of the changes observed in the climate are unprecedented in hundreds of thousands of years. The IPCC Sixth Assessment Report, published in 2021, warns that anthropogenic climate change is already affecting many weather and climate extremes in all regions of the world and that unless GHG emissions are significantly reduced over the next few decades, it will cause more severe and frequent natural disasters. The world must hold the increase in global average temperature to below 2°C or even to 1.5°C above the pre-industrial level by the end of the 21st century. Efforts to reduce GHG emissions are being made worldwide, and in Japan, the movement toward the achievement of a decarbonized society has been accelerating since the Japanese government’s declaration on Net Zero GHG Emissions by 2050.

Under these circumstances, the Tosei Group recognizes that the climate change will cause dramatic changes in the natural environment and social structure, and that it is an issue that will have a significant impact on our business. We also are aware that natural disasters could reduce the value of real estate and stricter government environmental regulations could significantly affect our business activities, strategies and financial plans. Tosei has established the Tosei Group ESG Policy and Action Guidelines and has also included initiatives to address environmental and social issues in its current medium-term management plan, Infinite Potential 2023. We will continue to strive to implement ESG management that takes sustainability into consideration and contribute to the realization of a sustainable and decarbonized society through our corporate activities.

The Tosei Group ESG Policy

The Tosei Group has a mission of creating new value and inspiration in all aspects of real estate as a global-minded group of seasoned professionals. It regards its commitment to the Environment, Social and Governance as a priority management challenge. It will seriously address the social issues associated with real estate to contribute to society and achieve its own continuous growth.

Supporting the Recommendations of the Task Force on Climate-related Financial Disclosures (TCFD)

We have expressed our support for the recommendations of the Task Force on Climate-related Financial Disclosure (TCFD) and are a member of the TCFD Consortium, an organization of supporters in Japan. Based on the TCFD recommendations, we will analyze the risks and opportunities posed by climate change to our business, and strive to further enhance climate-related information disclosure.

Governance

Organization Framework

Tosei Group has established the Sustainability Committee, which reports directly to the Board of Directors, to promote ESG management practices that take sustainability into account. Based on the Tosei Group ESG Policy and ESG Action Guidelines, the Sustainability Committee formulates policies to improve the Group's overall sustainability, including addressing climate change, formulates annual activity plans for ESG promotion, monitors, provides advice and guidance the progress of each measures and departmental activities.

The Sustainability Committee is chaired by the director responsible for sustainability (Noboru Hirano, CFO and Senior Executive Officer) appointed by the President and CEO, and consists of members appointed by the director. In principle, the committee holds six meeting a year, and its deliberations, activity status, and reported matters are reported monthly to the Board of Directors.

The Sustainability Committee identifies, classifies, analyzes, and evaluates risks and opportunities, and formulates organizational measures and response plans for adaptation and mitigation for climate-related risks in accordance with the Regulations for Risk Management Related to Climate Change. The measures approved by the Board of Directors are linked to business strategies under the leadership of the Sustainability Committee and are directed to the Group companies and their respective business units.

Role of the Board of Directors

The Board of Directors has the highest responsibility for climate change-related risk management, and shall establish the necessary organizational structure, appropriately supervise it, and provide instructions as necessary. In addition, based on reports from the Sustainability Committee, the Board of Directors appropriately monitors and supervises the progress of each measure and program, reviewing the policies and directing improvements to the promotion system as necessary. In addition, ESG promotion targets, including climate change, are set as items for evaluation and reward of full-time directors in charge of ESG.

|

Management and |

Board of directors | |

|---|---|---|

|

Person in Charge |

Person responsible for climate change-related risk management: *This person shall report monthly on matters related to climate change response at the Board of Directors meetings. |

|

|

Office |

Corporate Management department | |

Strategy

To understand the possible impact of future climate change on our group's business and to reflect such impact into our business strategy, we chose multiple future climate change scenarios defined by international institutions and identified risks and opportunities of the hypothetical world under each scenario. The details of the scenario analysis are as follows.

Determining Targets for the Analysis

In this scenario analysis, all our group's businesses are included as the target. Regarding the possible impact on real estate holdings, the analysis covers office buildings, commercial facilities, detached houses, apartment buildings, hotels, and logistics facilities as asset classes that are expected to be strongly affected by climate change, while pre-owned condominiums units, which have a small impact, were excluded from the analysis.

Determining Time Frames for the Analysis

In analyzing the scenarios, we used 2030 (medium-term) and 2050 (long-term) as time frames for the scenario analysis, considering the effects of climate change assumed in each scenario parameter will materialize in the medium to long term.

Assumptions Underlying Each Scenario

The TCFD recommendations advise the use of several scenarios, including a 2°C or lower scenario, to examine the resilience of the organization in an uncertain future.

Our group used the following two scenarios for our study and analysis.

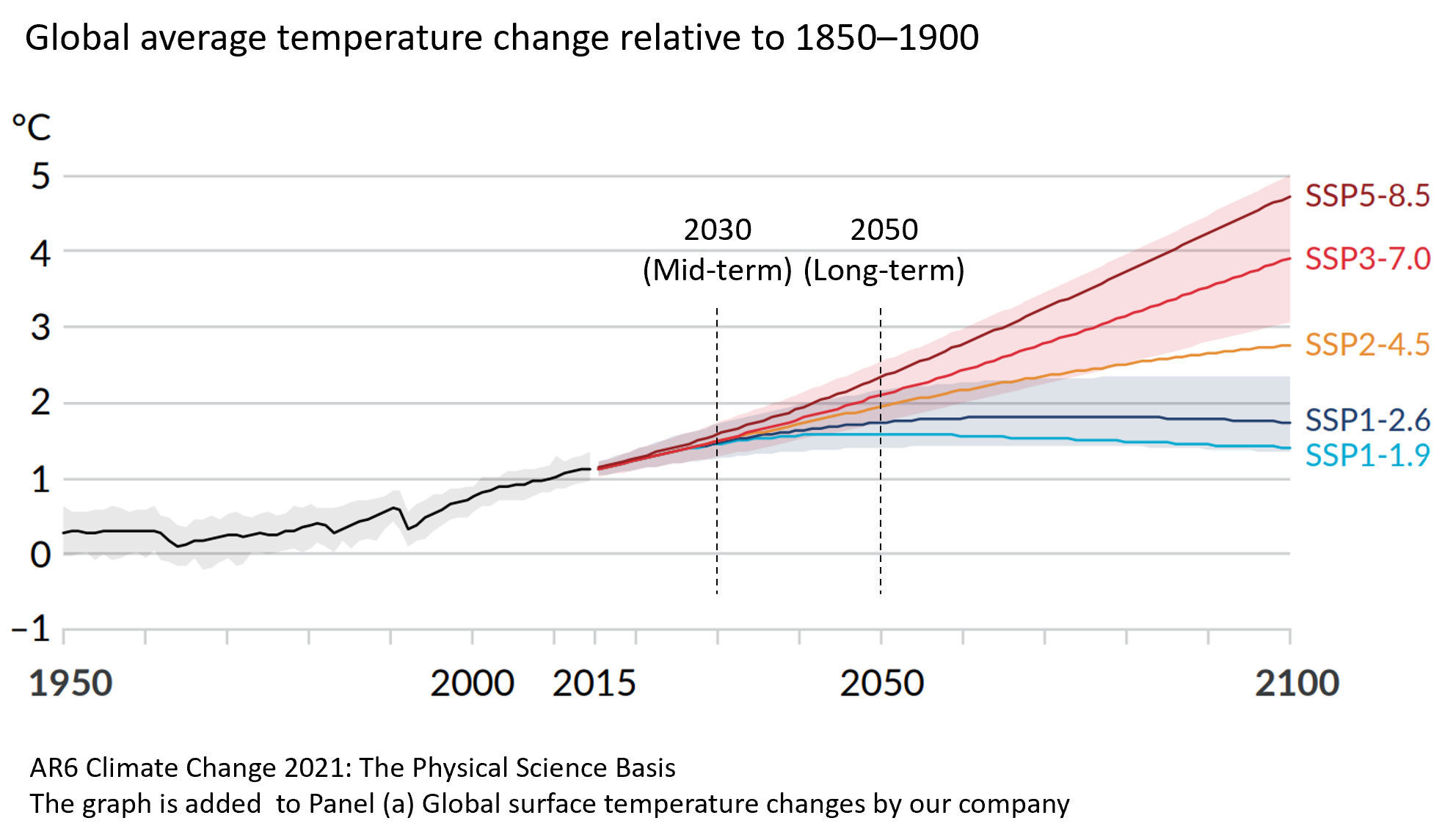

- (1)1.5°C–2°C increase scenario (high transition risks, low physical risks)

Under this scenario in which regulations and policies are strengthened for decarbonization, measures to address climate change are taken, and temperature rise is expected to be around 1.5 -2°C in 2100.

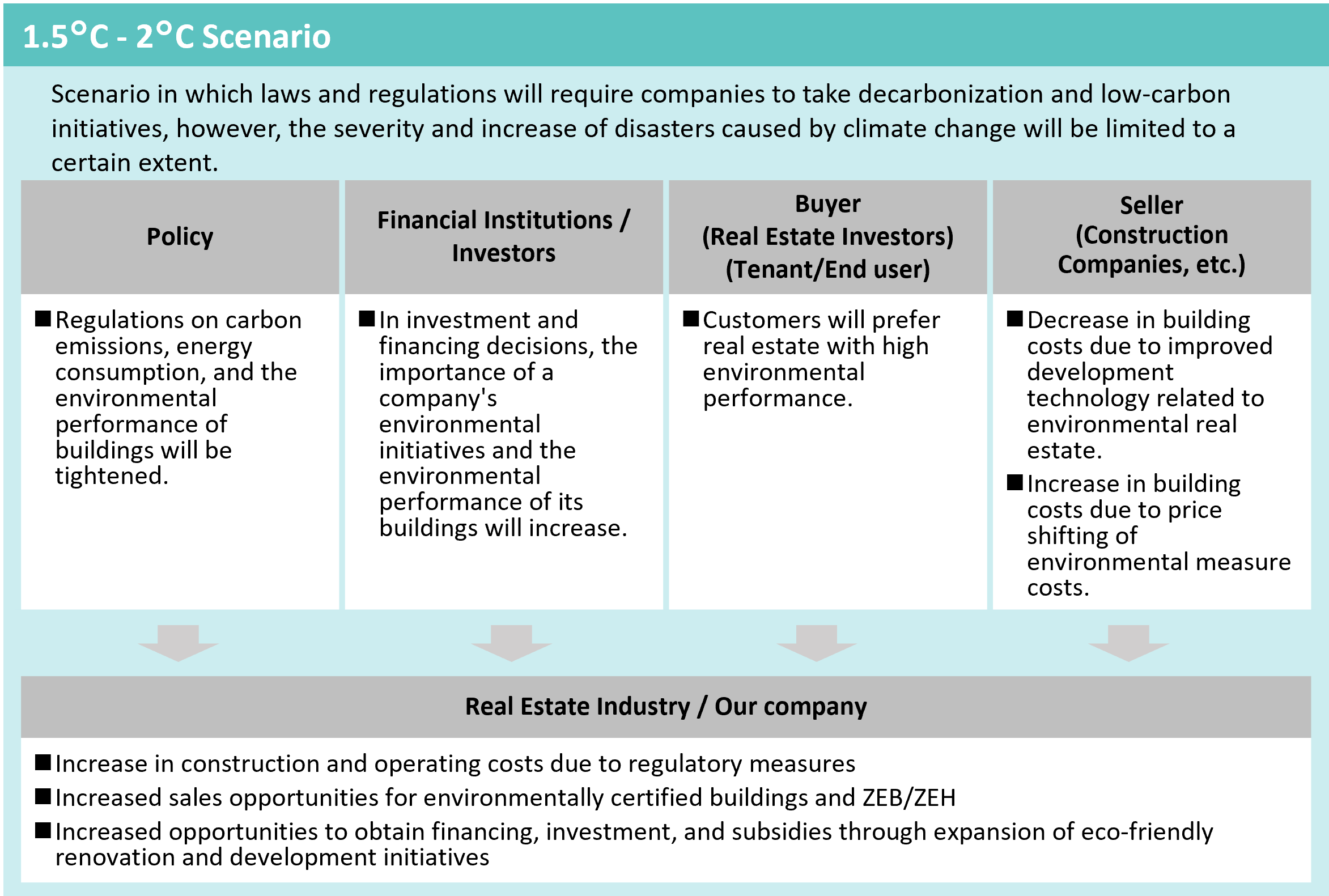

Companies are strongly required to respond to climate change, and if they do not, customer outflow and reputation risks will increase, resulting in higher transition risks, while physical risks will be relatively low, as the severity and increase of disasters caused by climate change will be suppressed into a certain extent. - (2)4°C increase scenario (low transition risks, high physical risks)

Under this scenario in which climate change measures are not adequately addressed and temperatures rise from pre-industrial levels to about 4°C by 2100.

Physical risks are assumed to increase, including more severe natural disasters, sea level rise, and an increase in extreme weather events.

This will increase the competitiveness of products and services with superior BCPs. On the other hand, transition risks will be lower, as government regulations will not be strengthened.

| Institutions/ Organizations | 1.5~2°C Scenario | 4°C Scenario | |

|---|---|---|---|

| Transition Risks | IEA (International Energy Agency) |

|

- |

| Physical Risks | IPCC (Intergovernmental Panel on Climate Change) |

|

|

Future World View of Each Scenario

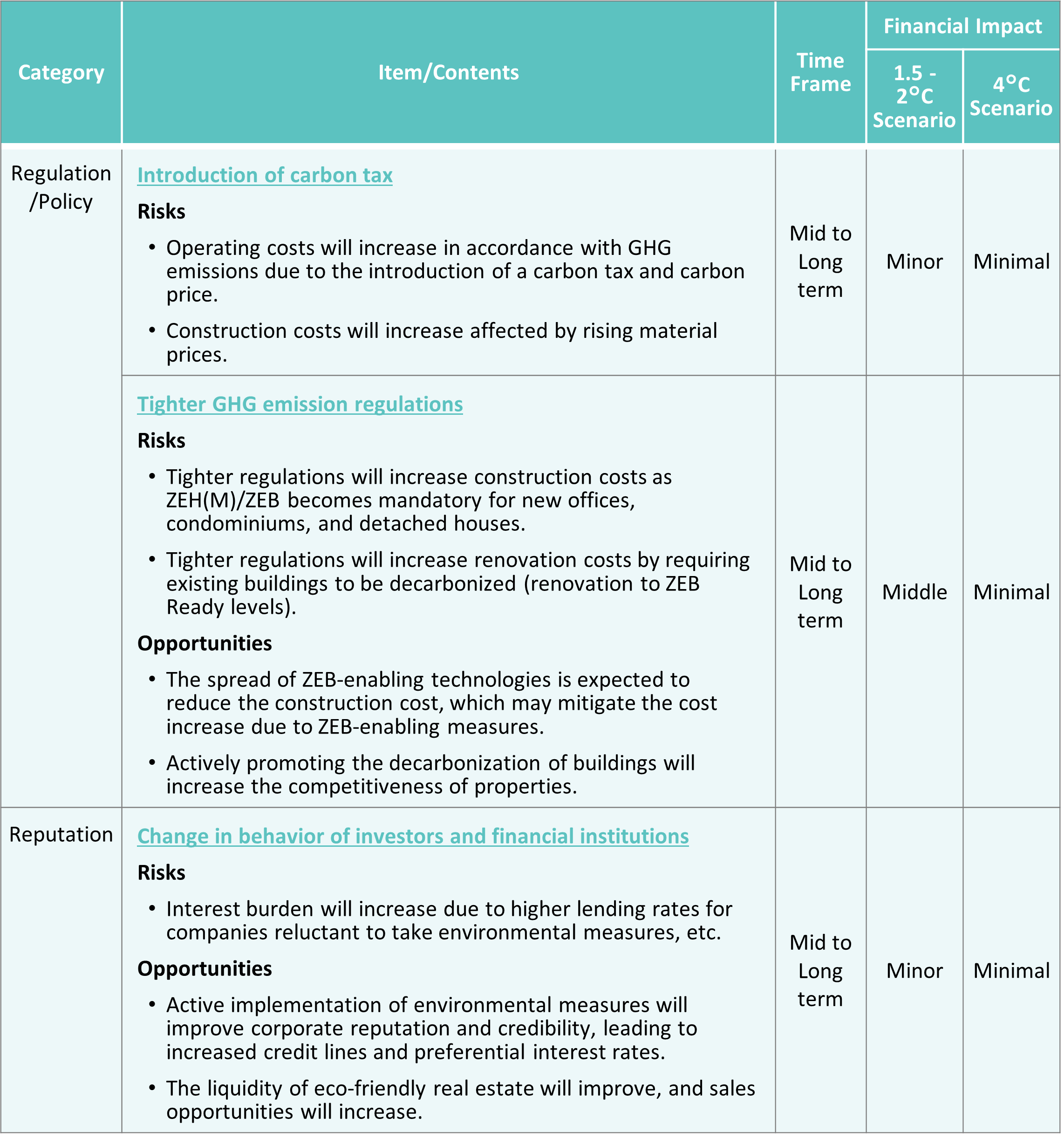

Identification of Risks/Opportunities Based on Scenario Analysis and Evaluation of Financial Impact

Based on the two climate-related risks and opportunities (Transition risks/opportunities and Physical risks/opportunities) categorized in the TCFD recommendations, we have identified the major risks and opportunities that are expected to have a significant impact on our business for each scenario. For each of the identified risks and opportunities, we evaluated the financial impact using parameters published by international organizations. The degree of impact on the Group was assessed on a four-point scale (major, medium, minor, and minimal) based on the materiality standards of the Tokyo Stock Exchange for timely disclosure, qualitative judgments take into account. Details are as follows.

Transition Risks・Opportunities

Resilience of the Group and the Results of the Analysis

The Group intend to switch using electricity generated from renewable energy sources for its head office and company-operated hotels. We will also promote internal resource and energy conservation efforts to reduce the Group's GHG emissions. moreover, we will aim to minimize risks and maximize opportunities by systematically promoting environmentally friendly product developments, renovating buildings to environmentally friendly real estate specifications, and acquiring environmental real estate certifications.

Physical Risks・Opportunities

Resilience of the Group and the Results of the Analysis

Strategies and Measures Developed Based on the Results of Scenario Analysis

Considering the aforementioned scenario analysis results, the Group will promote and consider the following measures in its management strategy and financial plan to minimize risks and maximize opportunities.

Utilize Renewable Energy

To reduce CO2 emissions from the buildings we own, we are working on the use of renewable energy in addition to energy conservation renovation work.

Tosei's head office building, the Tamachi Tosei Building, and Tosei Hotel Tsukiji Ginza Premier are powered by renewable energy, and Tosei is also working on local production for local consumption of energy by installing solar panels and storage batteries at T's eco Kawasaki as part of its value-up work to power some common areas as part of its renewable energy utilization in its regeneration business.

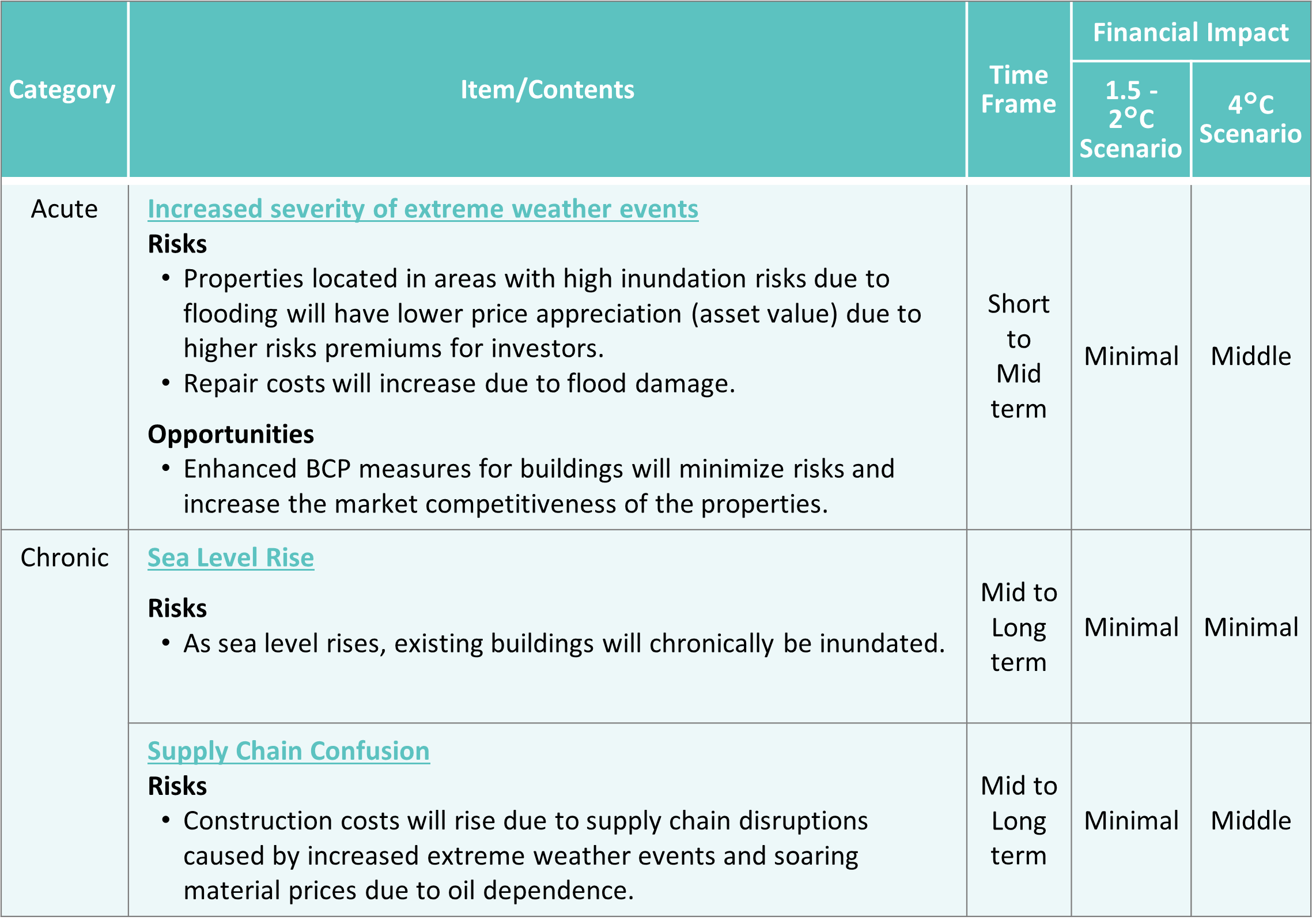

Reduce CO2 Emission through Revitalization Business

Tosei’s Revitalization Business is not only attractive as an investment product, but also leads to the utilization and extension of existing resources and is environmentally friendly. This means that, Tosei’s model as the utilization of existing used properties can reduce total amount of CO2 generated due to construction by 54% in comparison to the Scrap and Build Model during 100-year term.(According to our estimation)

Assumptions

Assuming that a newly constructed office building (total floor area: 10,000m2 , steel-framed reinforced concrete structure) will be maintained for 100 years*

TOSEI Value-Up Model

- Repair and maintenance work to be carried out every 10 years (8 times in total), and life-extension work to be carried out once every 30 to 40 years (2 times in total).

- Lengthening of service life = large-scale repair work for air conditioning, water supply, elevators, water-saving toilets, etc.

Scrap and Build model

- Repair work every 10 years (9 times in total), and once every 30-40 years, Demolish the existing building and build a new similar building (2 times in total).

*In order to extend the life of the building frame up to 100 years, it is assumed that the neutralization diagnosis of the building frame and its treatment have been taken. In addition, CO2 emissions from the work related to neutralization diagnosis and treatment are not considered.

Redevelopment project utilizing the building site

We are engaged in the redevelopment of former building sites acquiring land on which warehouses and other buildings once stood, improving the land, and constructing new buildings to create new communities.

We developed large condominiums on the former warehouse sites of a company engaged in food sales in Chofu City, Tokyo, and a company engaged in construction in Toda City, Saitama Prefecture. All of the condominiums have been designed to create a new community in the area through redevelopment, with enhanced plantings that harmonize with the surrounding environment and common areas designed to create a community of residents.

Initiatives to reduce GHG Emissions in the Real Estate Fund and Consulting Business

In our Fund and Consulting Business, through our asset management services, we promote energy-saving renovation of buildings owned by privately placed real estate funds and REITs, acquisition of environment-related certifications, and efforts to reduce GHG emissions.

Tosei Asset Advisors, Inc has established the Green x Value Up Residential Fund (hereinafter "the Fund") in FY2023, which aims to reduce whole-building GHG emissions through energy-saving renovations, working with domestic institutional investors.

The Fund will operate its properties with the goal of significant reducing GHG emissions for the whole-building by holding existing rental apartments over the long term and conducting energy-saving renovations not only of common areas but also vacant units. The Company will carry out the renovation work as construction manager, and the value of the property will be increased with a focus on the reduction of environmental impact, thereby revitalizing the property as a rental apartment building that contributes to the realization of a decarbonized society. In addition to LED lighting and the introduction of motion sensors in common areas, the installation of solar power generation equipment on the rooftop is planned along with the application of highly reflective paint. In the exclusive areas, water, lighting, and air conditioning equipment will be upgraded to energy- and water-saving models, and a Home Energy Management System (HEMS) is installed to enable the visualization and optimization of energy use.

Energy Conservation Efforts in Development Properties

The Group is actively adopting equipment and materials that contribute to greenhouse gas reduction and energy conservation in the properties it develops. We are also working to build houses that meet the ZEH (Net Zero Energy House) standard, and in the FY2023, we supplied 12 ZEH and long-life quality housing. We are developing products that incorporate the most advanced housing equipment and systems, including solar power generators, energy- and water-saving equipment, and IoT. We will continue with these efforts to provide houses that combine high energy-saving performance and comfort.

Major Environmentally-Conscious Equipment Installations

- Energy-saving water heater (Eco-Jozu, ENE-FARM)

- Double-layered glass

- LED lighting, motion sensor lighting

- Highly insulated design (equivalent to heat insulation performance grade 4)

- Highly insulated sashes

- Solar power generation system

- Rainwater utilization equipment (rainwater tank, water-retaining interlocking)

- Water-saving faucets, water-saving toilets

- Recycled materials

- Rooftop greenery, rooftop green/vegetable garden

- Electric car charging facilities

- Car sharing, bicycle rental

Promotion of LED Installation in Used Office Buildings

The Group is promoting the installation of LED lighting in the fixed assets it owns. To date, we have installed LED lighting throughout 7 existing office buildings and 1 existing logistic facility and reduced electricity consumption by an average of approximately 20% to 30%. This is expected to improve tenant satisfaction by reducing electricity consumption and costs, increasing the brightness of the buildings, and eliminating the need for maintenance.

Promotion of energy conservation in cooperation with tenants

To promote energy conservation in the properties we own, we are working with tenants to conserve energy.

Tenant Survey

We conduct an annual survey of all tenants of our buildings (fixed assets) to ascertain their needs regarding building management systems and facilities, etc. The Sustainability Committee of Tosei Community Corporation, which is responsible for the management of fixed assets, and the Sustainability Committee of Tosei confirm the results of the survey and take necessary measures to improve tenant satisfaction. The Sustainability Committee of Tosei Community Corporation, which is responsible for the management of fixed assets, and the Sustainability Committee of Tosei Corporation confirm the results of the questionnaires and take necessary measures to improve tenant satisfaction.。

Green Lease Agreement

For tenants of buildings that have undergone whole-building LED construction, we have entered into green lease contracts with tenants that stipulate that both the owner and the tenant will enjoy the benefits of energy conservation through the installation of energy-saving equipment, and that the tenant will work with the owner on various energy-saving activities that will contribute to improving the environmental performance of the property. As of the end of the fiscal period ended November 30, 2023, green lease contracts were in place for 8 properties, including Shinden Logistics, Awaji-cho Tosei Building, and others.

Energy conservation awareness activities

We are striving to raise building users' awareness of energy conservation and reduce energy consumption by distributing Sustainability Guides, which provide information on energy conservation activities, and by displaying posters to promote energy and resource conservation, waste separation, stairway use, and other activities.

Promotion of Acquiring Environmental Real Estate Certification

We are promoting energy-saving renovations, including the installation of LED lighting in buildings. We are also promoting the acquisition of certifications that evaluate the environmental performance and social aspects of real estate and use these certifications to enhance the value of our assets and for leasing.

Risk Management

Process for Identifying and Assessing Climate-related Risks and Opportunities

The Sustainability Committee, responsible for risk management related to climate change, conducts regular group-wide surveillance once a year and identifies climate-related risks and opportunities based on the results. The identified climate-related risks and opportunities are evaluated on two scales, “likelihood” and “impact” based on multiple assumptions (scenarios) about future climate change defined by international organizations and others. The results of the analysis are reported to the Board of Directors each time they are performed. Climate-related risks and opportunities in this analysis are based on the following definitions.

- 1.Transition Risks

Risks associated with the transition to a low-carbon society, which are risks brought about by changes in policies and legal regulations to address climate change, as well as changes in technological development, market trends, market valuations, etc.

(ⅰ)Current Regulations (Policy and Legal) Risks related to policy actions that attempt to constrain actions that contribute to the adverse effects of climate change (ⅱ)New Regulations (Policy and Legal) Risks related to policy actions that seek to promote adaptation to climate change (ⅲ)Technology Risks related to technology that may change or evolve with climate change among suppliers of materials and services related to each of the Group's businesses (ⅳ)litigation Risks related to climate-related litigation claims being brought before courts. (ⅴ)Market Risks associated with changes in the markets relevant to the business of the Group companies as society transitions to a low-carbon and decarbonized society in relation to climate change. (ⅵ)Reputation Risk of changes in the Group' s reputation with customers, investors, various suppliers, communities, governments, and others related to the Group in relation to climate change.

- 2.Physical Risks

Risk of exposure to acute or chronic damage from climate change and other causes brought about by climate change.

- 3.Opportunity

(ⅰ)Resource Efficiency Opportunities related to improving resource efficiency in the business activities of our Group. (ⅱ)Energy Source opportunities from shifting to low-carbon energy sources to meet the energy needs of our group companies' business activities. (ⅲ)Products and Services opportunities arising from low-carbon and climate change adaptive products and services of our group companies. (ⅳ)Market opportunities for our Group to enter new markets as we transition to a low-carbon economy. (ⅴ)Resilience opportunities arising from enhancing various adaptive capacities of our group companies to cope with climate change.

Processes to Manage Climate-related Risks and Opportunities

Of the identified risks and opportunities, the Sustainability Committee creates a plan for each element that the Tosei Group should address in an organized manner, and the Board of Directors approves the plan. The plan is formulated based on the basic framework of risk management, namely "avoidance," "acceptance," "mitigation," and "transfer”.

Under the supervision of the Board of Directors and in accordance with the instructions of the Sustainability Committee, the approved risk response plans are implemented by the respective business operation systems of Tosei and its group companies. The Sustainability Committee also takes the lead in linking the risk management plan to the business strategy by providing instructions to each Group company and their respective business organizations.

Status of Company-wide Risk Management Integration

The Risk and Compliance Committee, which is a committee directly under the Board of Directors, is responsible for centralized and cross-sectional risk management of the Tosei Group. The committee is responsible for implementing basic measures for the Group's risk management, responding to management crises that may occur as risks emerge, and overseeing and managing the various risks surrounding the Group's businesses.

Climate Change Risks and Opportunities, which are of particular importance among the company-wide risks and should manage following the framework recommended by the TCFD, are led by the Sustainability Committee under the supervision of the Board of Directors. The Risk and Compliance Committee ensure the integrated Enterprise Risk Management by assisting and supporting the Sustainability Committee in its implementation of various measures.

Metrics and Targets

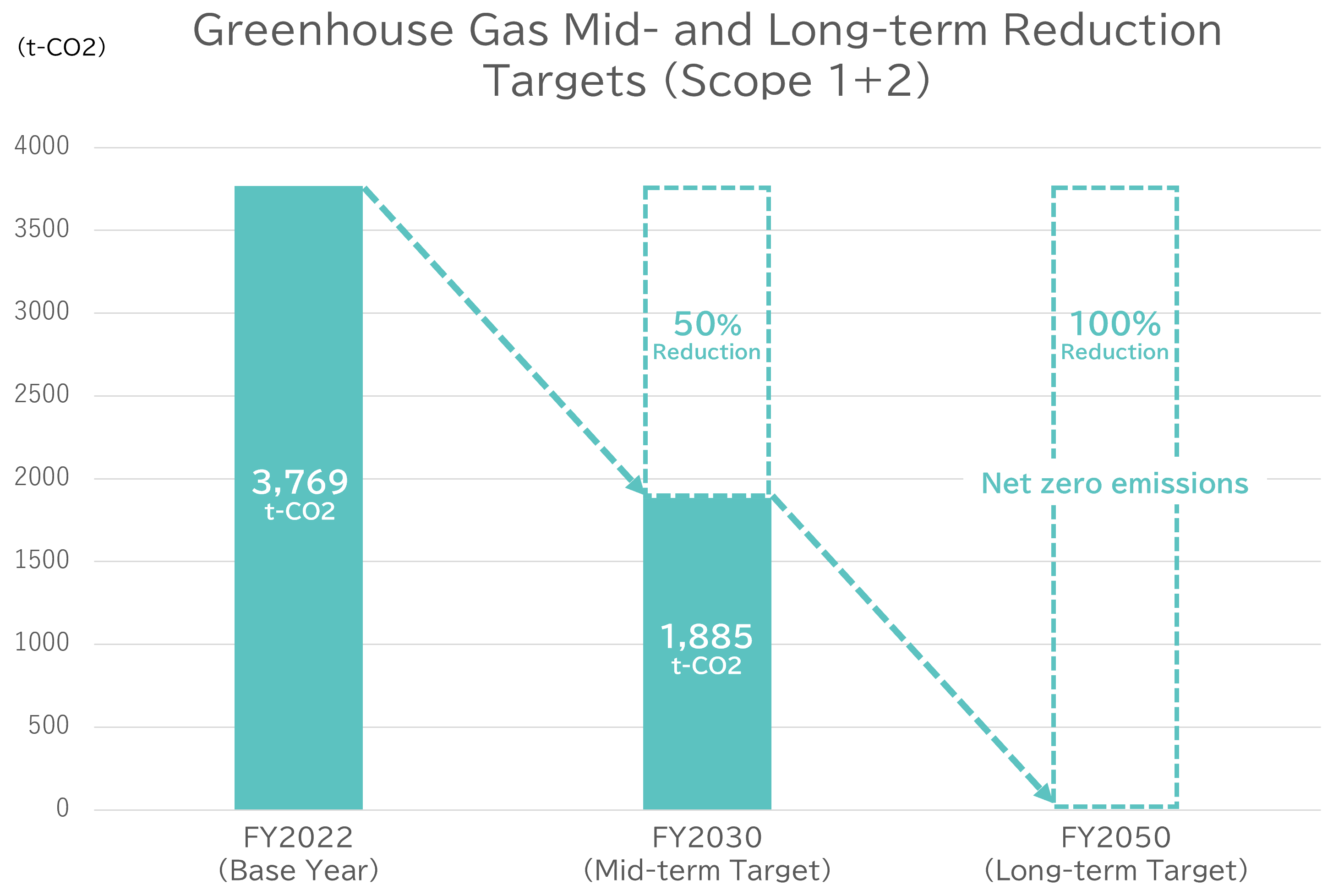

Disclosure Elements of Greenhouse Gas (GHG) Reduction Target

The Tosei Group has set the goal of achieving net-zero greenhouse gas emissions in Scope 1 and 2 in FY2050 to keep the global temperature increase below 1.5°C. In addition, the Company will pursue the following reduction targets over the medium term, with FY2022 as the base year.

| Base Year |

FY2022(From December 2021 to November 2022) |

|---|---|

| Reduction Target* |

Scope 1; direct emission of GHGs by business operators themselves, such as from combustion of fuel |

| Target Year / Reduction Ratio | Long-term Target: Net-zero by FY2050 Mid-term Target: 50% reduction from base year by FY2030 |

- *The GHGs emitted by our group consist of GHGs emitted directly from our company through the usage of city gas used at our headquarter, sales offices, and company-operated hotels and gasoline used in company vehicles (Scope1), and GHGs emitted indirectly through the usage of electricity at our headquarter, sales offices, and company-operated hotels and district heat and cooling used at our headquarter office (Scope2).

-

Greenhouse Gases (GHG) Emissions

| unit | FY2020 | FY2021 | FY2022 (Base Year) | |

|---|---|---|---|---|

| Scope1 (Direct GHG emissions) |

t-Co2 | 135 | 197 | 480✓ |

| Scope2 (Indirect emissions associated with energy sources) |

t-Co2 | 1,318 | 1,696 | 3,289✓ |

| Total (Scope1+2) |

t-Co2 | 1,453 | 1,893 | 3,769✓ |

- *The indicators with ✓ mark are guaranteed by an independent third party, Sustainability Accounting Co.,Ltd.

Click here for the warranty report. - *The greenhouse gas emissions shown above are the total emissions from the business activities of all domestic consolidated subsidiaries of the Tosei Group, based on the GHGs Protocol's control criteria.

- *The figures for FY2020 include estimates in some cases.

- *For FY2021 calculation, the Princess Group, which became a consolidated subsidiary in October 2021, is not included.

- *The Group excludes GHGs (Freon gas, etc.) other than CO2 due to their extremely small amounts, and calculates and reports only CO2.

- *The GHG emission factor is based on the "Emission Factor by Electric Power Company" published by Ministry of the Environment and Ministry of Economy, Trade and Industry, and uses the emission factor of the electric power company used by the subject building.

- *As of November 30, 2022

Disclosure Based on TCFD Recommendations (Announced on September 28, 2022)

Based on TCFD recommendations, we disclosed information about Governance, Strategy, Risk Management, Metrics and Targets related to climate change risks and opportunities. We will continue to promote our measures to climate change issues and strive to further enhance climate-related information disclosure.

*Progress after September 28, 2022 is reported as needed on the "Climate Change" page.