Compliance and Risk Management

Compliance and Risk Management Promotion System

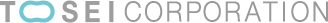

Compliance and Risk Management System

The Group has established the Risk and Compliance Committee to promote integrated and cross-sectional risk management and compliance across the Group. The committee identifies, analyzes, and evaluates the risks of the entire Group, gather information about specific risks and to discuss measures to address them, and facilitates compliance promotion. The committee is chaired by CFO and Senior Executive Officer who oversees all administrative divisions except the Internal Audit Department. As a subordinate body of the Committee, the Business Law Liaison Committee, attended by all heads of the operational divisions, are held every month, during which participants are duly made familiar with amendments to laws and regulations. In case of occurrence of a contingency, a natural disaster, etc., a crisis management office directed by the President and CEO as the head will be established to collect information, confirm facts and circumstance, develop and implement countermeasures, and properly disclose information in a timely manner. The Board of Directors receives monthly reports on the results of deliberations and progress of the Risk Compliance Committee, and appropriately supervises the operation and compliance Risk Managment System of these committees.

Regarding each Group company, the Company’s full-time Directors, Executive Officers in the Administrative Division, etc. are concurrently appointed as Director or Audit & Supervisory Board Member for each Group company with the remit of monitoring and supervising each Group company’s responses to risks. Every month, each Group company reports management conditions and their responses to risks at the meeting of the Board of Directors or pre-Board meeting discussions of the Company, and the Risk Management and Compliance Committee’s meeting. Moreover, the response of these Group companies and the results thereof are continuously audited or monitored by the Company’s Internal Audit Department, which may also conduct checks using external agencies as necessary, and then the Internal Audit Department reports the results at the Board of Directors’ meeting.

Risk Management and Compliance Committee

Tosei has established the Risk and Compliance Committee, which consists of the Executive Officers, heads of each department, officers responsible for risk management and compliance at each Group company, and full-time Audit & Supervisory Board Members, as a body to examine risk and compliance in Tosei Group in a centralized and cross-sectional manner. The committee deliberates on the recognition, analysis and evaluation of risks of each Group company, information gathering and discussion of countermeasures for individual events, and promotion of compliance. According to the "Risk Management and Compliance Program" formulated each fiscal year, we are strengthening our compliance awareness, implementing the PDCA cycle for risk management, and strengthening monitoring.

Compliance and Risk Management Promotion System

Risk Management and Compliance Program

In order to promote compliance and accurately manage the various risks surrounding our business, the Group formulate and implement a group-wide Risk Management and Compliance Program every fiscal year. This program is approved by the Board of Directors after evaluating the effectiveness and functionality of the risk management process and through discussions by the Risk Management and Compliance Committee. In addition to the Program, Tosei and its Group companies formulate and implement individual programs that take into account the business environment and organizational structure of each company, and regularly report their progress to the Risk and Compliance Committee.

Risk Management and Compliance Program

(1) Identify, analyze and evaluate risks

(2) Formulate and implement measures to address identified risks

(3) Monitoring the effectiveness and functionality of countermeasures

(4) Management cycle plan to inform the employees of measures to handle risks

(5) Measures and training plans to enhance compliance awareness

(6) Plans for education, training, seminars, and other activities for risk management and promotion of compliance

Risk Management and Compliance Guidebook

The Group Risk and Compliance Guidebook is distributed to all Tosei Group officers and employees as a specific guide to ensure that they correctly understand risk and compliance and conduct business with awareness of compliance. The Guidebook explains the Tosei Group Ethics Code, specific points to note regarding compliance with laws and regulations, and the internal reporting system, and will be revised as necessary. In addition, the Company strives to enhance employees' awareness of compliance by informing them through training and other programs conducted every year.

Risk Management

The Group aims to earn trust from stakeholders by drawing up plans and implementing measures even during normal times to address risks that might prevent it from conducting business activities and maintaining and improving corporate value, and by developing a system for minimizing losses.

Business Risks Management

In accordance with the Risk Management and Compliance Program formulated at the beginning of each fiscal year; 1. implement a survey to identify about 30 significant risks that have material impacts on the Group’s business, 2. conduct stress tests (twice a year), taking account of real estate market conditions, transaction conditions, and the financing status of financial institutions. The results are reported at the Board of Directors’ meetings. In addition, at monthly Risk Management and Compliance Committee’s meeting, the states of our responses to emerging risks are checked, information gathering efforts on latent risks are continued, and the details are reported at the Board of Directors’ meeting held each month, in addition to which the outcomes of the responses are monitored by the Internal Audit Department. We have also instructed each Group company to formulate plans for managing risks and promoting compliance in light of each company’s business operations, focusing on ensuring that the parent company organization appropriately supports these plans.

<Major business risks recognized by the Group and supervised by the Board of Directors>

- Economic conditions

- Calamity and natural disasters

- Dependency on interest-bearing debt dependence and interest rates

- COVID-19

- ESG (environmental, social and governance risks, climate change risks, etc.)

Action in the Event of a Crisis or Disaster

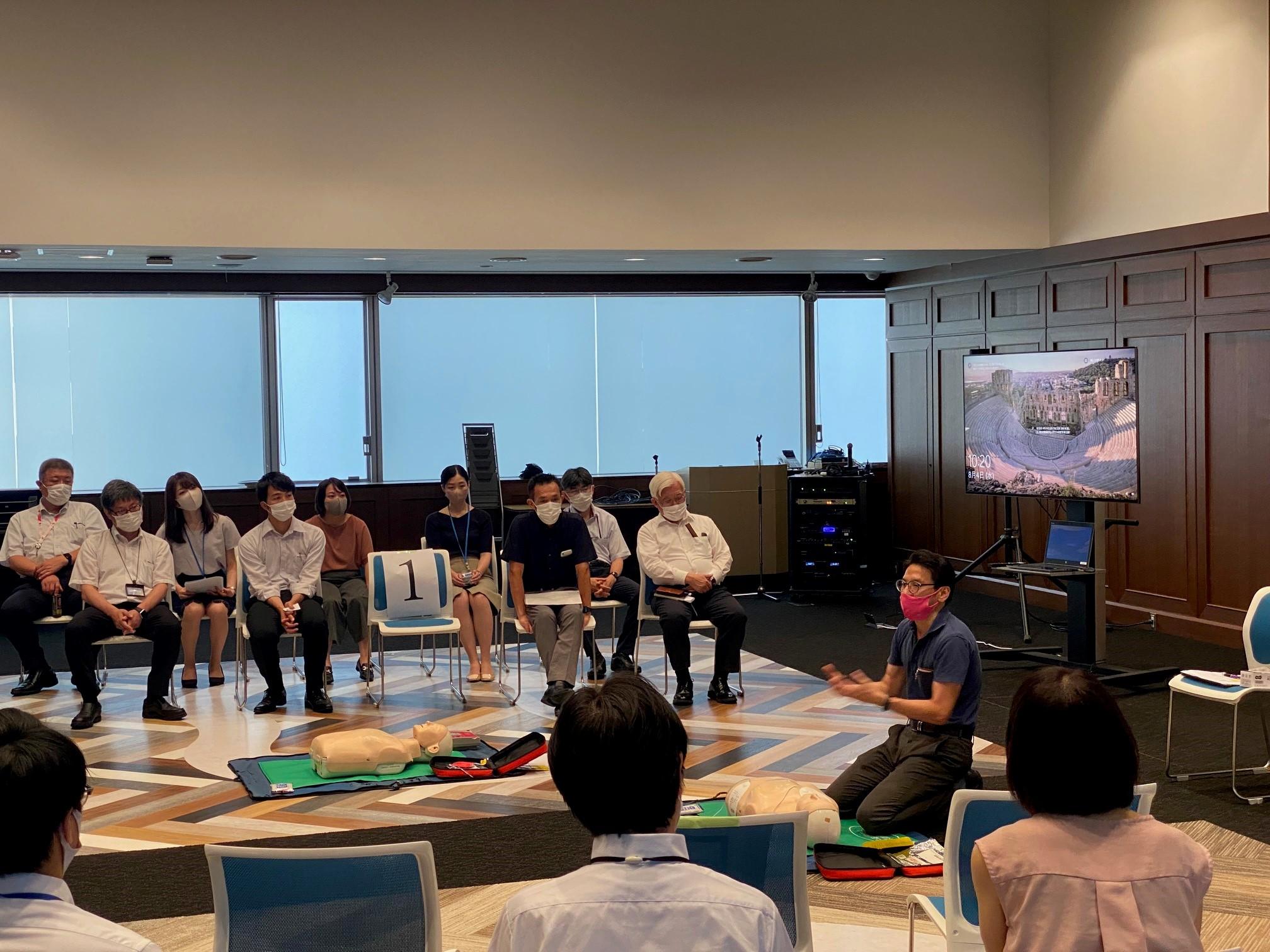

The Company recognizes situations that are potentially damaging to its corporate value, such as large-scale natural disasters and incidents, accidents, and events that impact generally on customers, residents, and wider society, as management crises and, if such an event were to occur, it would set up a Crisis Management Office headed by the CEO, and would take action to control the situation in collaboration with the Risk Management and Compliance Committee members and relevant departments. We have also established a Crisis PR Manual to speed up and facilitate corporate communication activities in the event of a crisis and are working to raise awareness about dealing with crises properly. In addition, we have established a Disaster Response Manual that details the steps from gaining a basic understanding of the disaster to making an initial response in the event of earthquake, fire, or other disaster, right down to conducting evacuation and relief activities, and also conduct a range of drills including evacuation drills, AED practice drills, and in-house fire-fighting team fire drills.

Action to Ensure Business Continuity

The Company has formulated a Business Continuity Plan (BCP) to ensure that, in the event of a natural disaster, incident, accident or other event that forced the Company to suspend its core business operations or that made business activities under the normal organizational/personnel structure difficult, the Group would be able to swiftly implement measures to continue business or resume business quickly.

Information Asset Management

Recognizing that information asset is one of our most important management resources, we have set out provisions for developing and maintaining information management environments in order to properly protect and efficiently utilize information in the Basic Policy on Information Asset Management, and we have established Information Asset Management Regulations and Personal information Protection Rules. In addition, every fiscal year we implement training for the information asset management, including personal information, and for the prevention of insider trading for all employees of the Company, and by doing so, we have continued to educate and inculcate rules for the handling of important information. In addition, to reduce the risk of information leakage and information isolation due to targeted attack e-mails, etc., we conduct mock drills and network vulnerability assessments by external third-party organizations. Regarding to the state of compliance with rules for the handling of information assets (printed and electronic information), in addition to self-inspections implemented at all departments and audits conducted by the Internal Audit Department, we have strengthened the penalties for breaches and continued targeted guidance for those who infringe the rules.

In the FY2022, the Group appropriately complied with the amended Act on the Protection of Personal Information and implemented training for employees, etc. to help improve IT literacy with the aim of strengthening information management system (total 22 courses, 30 hours of training). In addition, we conducted mock drills related to targeted e-mail attacks and vulnerability assessments of our internal network by an external third party to reduce the risk of information leaks and information isolation triggered by fast-growing network crimes. Furthermore, we reviewed contracts with external subcontractors related to maintenance and other operations of the IT environment at each of the Group companies to enhance information management systems including that of the Company. Also, an electronic contract (signature) system was introduced for some contracts to prevent the leakage of documents and other materials, including material information, outside the Group.

Advertisement Screening

The General Affairs Department, which is responsible for legal affairs, conducts inspections of advertisements and other displays and the provision of premiums in each of our businesses, depending on the target of the advertisement and the advertising media used, in order to help ensure proper business operations in compliance with relevant laws and regulations. Specifically, the General Affairs Department checks for compliance with the Advertisements and Premiums Screening Manual, and makes corrections and recommendations as necessary to promote appropriate advertising and marketing activities.

Compliance

The Group considers compliance to be one of its most important management issues and has established The Tosei Group Ethics Code and The Tosei Group ESG Action Guidelines to be followed by all directors and employees of the Group. We are working to strengthen our compliance by ensuring that all employees are fully aware of the code and guidelines.

The Tosei Group Ethics Code

The Group has established the Tosei Group Ethics Code, matters to be complied with when employees carry out operational activities, and keeps them informed of and complied with the ethics code through distributing the Tosei Group Risk and Compliance Guidebook and training, etc. In addition, we conduct a questionnaire survey to all directors and employees of the Group annually to assess the degree of penetration of compliance and the Group Philosophy and to regularly check its effectiveness, and revise the Code of Conduct and training programs.

The Tosei Group Ethics Code

To fulfill our corporate social responsibility, we will always attach importance to a high standard of ethics and a law-abiding spirit while pursuing our corporate philosophy, and will conduct our business activities in accordance with the following Code.

- 1.Sustainable economic growth and resolution of social issues

We will strive for sustainable growth and the resolution of social issues by always putting ourselves in our customers' shoes and positioning safety and security at the heart of the products and services we develop and provide, and by forever remaining humble and conducting business activities in good faith. - 2.Fair Information Disclosure

We will disclose the necessary corporate information in a fair, timely and appropriate manner in order to obtain proper evaluation and understanding from investors and wider society. - 3.Fair and transparent decision-making

We will make decisions based on appropriate and explainable reasoning, in accordance with laws, regulations and internal rules. - 4.Thorough compliance with laws and regulations and fair dealings

We will understand both domestic and international laws and regulations and will never engage in any conduct that violates such legislation, or in any fraudulent conduct. We will also engage in fair and free competition and appropriate transactions, and will avoid becoming involved in bribery or other similar giving or receiving of unfair advantage in any way. - 5.Comprehensive crisis management

We will not have any relationships with antisocial forces and will conduct thorough and organized crisis management to prepare for a terrorism, cyber-attack, natural disaster or other crisis. - 6.Protection of confidential information

We will protect and strictly manage the material information of the Tosei Group, the personal information of customers, the information of business partners, and other confidential information. - 7.Respect for human rights and creation of positive work environments

We will respect human rights and will not tolerate any behavior which violates the dignity of individuals including discrimination and harassment. We will also strive to develop human resources and create working environment with mutual trust and decency. - 8.Initiatives to address environmental issues

We will contribute to the realization of a sustainable society by implementing initiatives to reduce our environmental impact, recycle resources and address the risk of climate change, based on a strong awareness of the importance of environmental issues. - 9.Social Contribution

We will seek harmony with local communities and the global community as a good corporate citizen and actively and continuously promote activities that contribute to society. - 10.Commitment of Top Management

The Tosei Group's Top Management recognizes that it falls to them to embody the spirit of this Code and, in the event of a violation of this Code, top management will proactively take charge of resolving the issue, endeavor to identify the cause and prevent a recurrence, demonstrate accountability, including the disclosure of information to markets and society in a timely and appropriate manner, and fairly and strictly punish those involved, including themselves.

Enhanced Compliance

- To ensure awareness regarding compliance with laws and regulations, at the beginning of each fiscal year the Risk Management and Compliance Program is drawn up, and training in the relevant laws and regulations, measures to cultivate awareness of legal issues have been implemented. In addition, Risk Management and Compliance Committee’s Meeting and Business Law Liaison Meeting are held every month, during which participants are duly made familiar with amendments to laws and regulations, etc., and notices from ministries with jurisdiction, etc. Furthermore, a compliance and corporate philosophy questionnaire is circulated every fiscal year to all officers and employees of the Group in order to identify issues and consider responses to such issues, and reflect them to each measure for the next fiscal year’s Program.

- In order to strengthen the screening function for violations of laws and regulations, the Company confirms signs and occurrences of violations of laws and regulations, gives instructions on how to respond to such violations, and reports the status of such violations at the Board of Directors meetings and other important meetings and committees attended by full-time directors. In addition to monitoring and supervision by three outside directors and four corporate auditors (all of whom are outside corporate auditors) at meetings of the Board of Directors, meetings are held regularly to exchange opinions between corporate auditors and outside directors and between corporate auditors and legal counsel to confirm signs of legal violations by directors who execute operations. Moreover, full-time Audit & Supervisory Board Members conduct business audits on the Company’s businesses and investigation of subsidiaries, while the Internal Audit Department conducts internal audits on the Company and the Group companies and self-inspections at the departmental level are implemented. Meanwhile, the Company continues to operate the whistle-blowing system providing three points of contact, internal, external and through Audit & Supervisory Board Members, and to conduct training sessions to promote an understanding of the system including protection of whistle-blowers.

Fair Business Practices

The Tosei Group promotes sound business activities under the Tosei Code of Ethics, which states ensures compliance with laws and regulations and fair business practices.

(Excerpt from the Tosei Group Ethics Code)

- 4.Thorough compliance with laws and regulations and fair dealings

We will understand both domestic and international laws and regulations and will never engage in any conduct that violates such legislation, or in any fraudulent conduct. We will also engage in fair and free competition and appropriate transactions, and will avoid becoming involved in bribery or other similar giving or receiving of unfair advantage in any way.

The Tosei Group Risk Compliance Guidebook clearly outlines our commitment to fair business practices and compliance with laws and regulations from a global perspective. In addition to compliance with the Anti-Monopoly Act, the Subcontract Act, the Building Lots and Buildings Transaction Business Act, the Financial Instruments and Exchange Act, and other laws, the guidebook specifically outlines actions that impede fair, transparent, and free competition, and strives to foster compliance awareness.

Response to Anti-social Forces

The Company always treats any association with anti-social forces as a critical matter and takes countermeasures to refuse any transaction with such. In the event any dispute arises between the Company and anti-social forces,we will stand firmly against them. We formulated a manual for acting against anti-social forces, and the Tosei Group Risk Compliance Guidebook is distributed to employees and is thoroughly communicated through training programs. In addition, we are striving to eliminate any relationship with antisocial forces by conducting thorough investigations of business partners in our daily operations.

Prevent Bribery and Corruption

The Group Ethics Code prohibits bribery or other similar giving or receiving of unfair advantage in any way. All types of activities which lead to corruption such as money laundering and illegal political contributions and donations are prohibited, such as entertaining, gift-giving, and the giving and receiving of cash or a cash equivalent to customers or business partners for the purpose of offering undue or improper advantage or enjoying preferential treatment.

Anti-Corruption Initiatives

- The Group endeavors to raise awareness about all the types of activities that lead to corruption, such as bribery and money laundering, by detailing in the Tosei Group Risk Management and Compliance Guidebook examples of illegal activities and specific action to be taken as part of business activities, including procedures for verifying compliance of beginning of the transaction with laws and regulations and for reporting detected breaches, and by distributing this guidebook to officers and all employees and providing training.

- For business affairs judged to involve high potential risks of corruption (specified business affairs/specified transaction in building lots and buildings transaction business, financial instruments business and real estate specified joint enterprise pursuant to the Act on Prevention of Transfer of Criminal Proceeds), the Group has developed a management system for verification at the time of transaction and suspicious transaction reports. For transactions that are considered particularly high-risk, we regularly review risk assessments based on the contents of the Risk Assessment Report on Transfer of Criminal Proceeds published annually by the National Public Safety Commission and our past reports of suspicious transactions, and the general manager approves the execution of transactions after conducting rigorous confirmation at the time of transaction. Further, whilst the Group has little involvement in public projects, its internal regulations prohibit entertaining and gift-giving in relation to public officials in light of the risk of bribery. Additionally, receiving excessive gifts or entertainment from business partners and contractors is prohibited, and any officer or employee found to have engaged in such corrupt practices shall be subject to disciplinary action or other punishment in accordance with internal regulations.

- The Group asks business partners (contractors) with which annual transactions exceed a certain amount to complete a questionnaire to verify compliance with laws and regulations including bribery and corruption, and determines whether or not to continue transactions based on verification results.

- The Risk and Compliance Committee monitors any signs of breaches of laws and regulations or misconduct including anti-corruption, and promptly takes corrective measures and recurrence prevention measures when fact-finding investigations reveal a breach or potential breach.The Board of Directors receives monthly reports from the Risk Compliance Committee and appropriately supervises these implementation and operation of the system.

Penalty charges, surcharges and settlements related to corruption

The Group has not been in violation of any laws or regulations or incurred any fines or penalties related to corruption or bribery. In addition, no employees have been punished or dismissed by the rules and regulations or codes related to corrupt prevention.

(FY2022: 0 violations of laws and regulations, 0 fines, etc., 0 punishments or dismissals)

Political Donation

The Company does not provide illegal donations or political contribution. When providing support for the activities of political organizations, we conducted appropriately in accordance with the Political Funds Control Law, laws and regulations. The amount of political donations for FY2022 was 760,000 yen.

Provisions for Fines and Settlements Related to ESG (Environmental, Social and Governance) Issues

As of November 30, 2022, there were no material provisions for fines or settlements related to ESG issues that arose from matters prior to FY2021 and are likely to arise in the future.

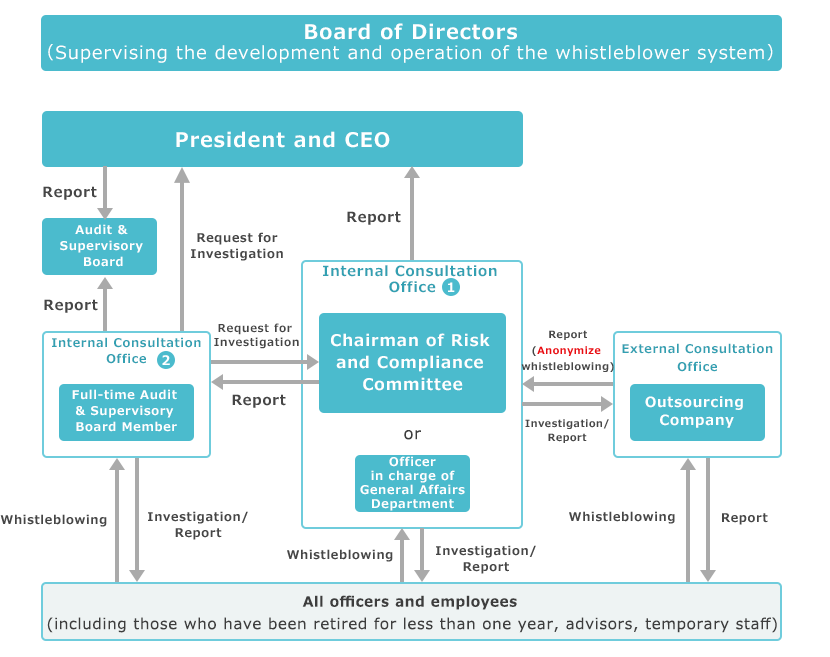

Whistleblowing System(Tosei Hot Line)

Outline of Whistleblowing System

The Group established the "Tosei Hot Line" as a whistleblowing hot line, which Group officers and employees (including those who have been retired for less than one year, advisors, temporary staff) can use to report any identified breaches of the Ethics Code or identified breaches or potential breaches of laws and regulations including corrupt practices. Whistleblowing reports are treated in confidence. There is also the option of using an external hot line to make reports anonymously. Whistleblowers are protected under the Whistleblower Protection Act and the Risk and Compliance Regulations, to ensure that they do not suffer any detriment as a result of making a whistleblowing report. When investigating the facts, the Group uses external experts, such as legal advisors and certified public accountants, where necessary, and promptly takes corrective measures and recurrence prevention measures in the event of discovery of a breach or potential breach. The Group follows up by verifying whether the corrective measures and recurrence prevention measures worked effectively and by making sure that whistleblowers did not suffer any detriment. The Board of Directors appropriately supervises the maintenance and operation of the whistle-blowing system by receiving regular reports from the Risk and Compliance Committee on the operation of the whistle-blowing system.

In FY2022, the Company revised relevant internal regulations, etc., to appropriately comply with the amended Whistleblower Protection Act (enforced in June 2022), and further ensured that officers and employees are well aware of the importance of protecting whistle-blowers.

Moreover, separate from the whistleblowing hot line, the Group has established a Harassment and Work-Style Consultation Hotline in the personnel organizations of each Group company for the purpose of preventing harassment and speeding up its detection, and dealing with inquiries about work-style reform and personnel systems.

Response to Compliance Violations

In case an investigation of the facts reveals a violation or potential violation of laws and regulations, we will take disciplinary action against the violator, other appropriate measures, corrective actions, and measures to prevent recurrence, as well as reporting the matter to relevant administrative agencies and taking legal action as necessary.

【Number of violations】

In FY2022, 4 whistleblowing cases were reported and 0 cases were found to be noncompliance.

Education and Training

Education and Training

In FY2022, the Group conducted various types of training based on the Risk Management and Compliance Program approved by the Board of Directors. More specifically, harnessing the merits of group training and online training respectively, the Group provided Antisocial Forces Response Training aimed at eliminating ties with antisocial forces, Financial Instruments and Exchange Act Training for employees engaged in financial instruments business, ESG Training to increase knowledge about ESG, and Harassment Training aimed at eliminating harassment. In addition, we had legal advisors offer a training course regarding relevant laws and regulations amended during the current fiscal year, including the Whistleblower Protection Act and the Act on the Protection of Personal Information. We have been promoting legitimate and appropriate business activity and raising awareness of compliance with laws and regulations by distributing videos of lectures by full-time directors on the Group's philosophy.

The Group also continuously sought to increase understanding of the Ethics Code and the Whistleblowing Hot Line and to promote understanding of relevant business acts and insider trading rules and prohibited activities that directly lead to breaches such as harassment and bribery through activities to further foster employees' compliance awareness, such as morning meeting addresses by officers, the display of compliance slogans in offices, and the posting of simple videos on the internal website.